Digitizing your organization’s accounts payable (AP) function delivers many benefits, including improved efficiency, transparency, and security. However, the journey to achieving AP automation can be complex.

You need to decide which processes to automate, which tools to use, and how to manage integration with your existing systems. In addition, you have to consider higher-level concerns like gaining buy-in from senior leaders and setting goals and KPIs for your transformation efforts.

Building a detailed AP transformation roadmap helps ensure the digitization process runs smoothly and delivers your organization’s desired results. Read on to learn more about how you can make your roadmap clear, actionable, and effective.

Key takeaways

- Digital transformation solves many common AP pain points, including late payments, high costs, weak security protections, and a lack of transparency.

- To reap the full benefits of transformation, you need to build a comprehensive roadmap to guide every step of the process, from identifying your AP team’s most pressing challenges to adopting the right automation platform.

- By executing your transformation roadmap, you’ll free up your AP team’s time for more strategic work that drives business results across the organization.

What is transformation in accounts payable?

Digital transformation has become an increasingly important priority for companies as they seek to improve efficiency across the financial department. According to Deloitte, 42% of CFOs reported being co-leaders of transformation, while 16% noted they are leading the effort. Eight out of 10 CFOs also agree that they are looking to implement more automation or digital technologies in 2024. By automating back-office functions, finance teams can focus on providing additional value to the organization instead of completing mundane but necessary tasks.

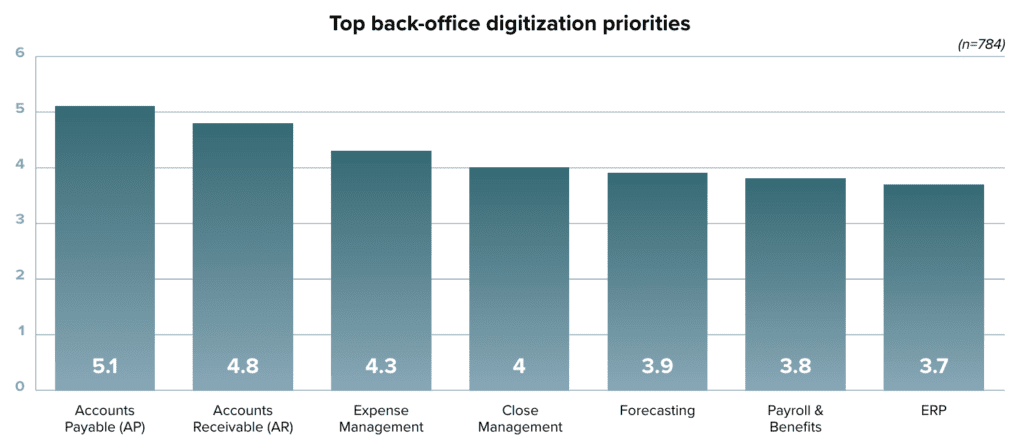

Digital transformation can take multiple years to complete. Focusing on one aspect at a time is important for CFOs and financial leaders looking to automate more of the back office. While many financial functions would benefit from digitization, AP transformation, in particular, offers numerous benefits. In fact, most finance professionals surveyed agree that AP automation is their top digitization priority over other back office technology needs.

Transformation in accounts payable modernizes and optimizes how an organization manages its invoice payments. This transformation typically involves moving from traditional, manual methods to automated solutions that streamline processes, reduce errors, and enhance visibility. AP digital transformation can help companies improve relationships with strategic suppliers, optimize payment methods, and provide robust analytics.

Challenges in AP today

Many businesses face significant challenges in their AP process, including error-prone manual data entry and processing, lack of visibility, fraud, inefficient workflows, high costs, and difficulty scaling and maintaining compliance. As a result, AP teams face inefficiency, errors, and increased costs across their workflows.

To combat these challenges, businesses are switching to an automated solution, but embarking on a digital transformation can often be a significant hindrance to their existing legacy systems. “A lot of the technology for big companies was built decades ago in an old legacy-system model that’s very hard to adjust,” says Michael Bender, a senior partner in McKinsey’s Chicago office and the global co-leader of McKinsey Digital and Analytics. Legacy systems can make it complicated to adjust business objectives or to account for changes in the current marketplace.

Additionally, many enterprise resource planning (ERP) systems are incredibly complex. Any change to a workflow or process may require help from outside consultants, stretching out timelines and increasing costs.

Benefits of AP transformation

Digital transformation creates several benefits for accounts payable teams, which we highlight below.

- Reduced errors: Relying on manual data entry increases the risk of errors in supplier information, coding, or other areas that can cause duplicate payments. Automating AP processes reduces human error and cuts down on duplication and other issues.

- Helps avoid late payments: Inefficient manual workflows make it difficult to process invoices in a timely fashion. Digitization streamlines AP processes and helps avoid late payments, strengthening relationships with vendors.

- Improved visibility: A digitized process allows AP managers to see invoice status, making it easy to track efficiency metrics or diagnose and correct any issues that arise.

- Cost efficient: Time is money, and manual AP processes take a great deal of time. Streamlining and automating AP workflows boosts cost efficiency and helps AP departments stay on budget.

- Strengthened internal controls: Because they handle sensitive payment information, AP departments are often targeted by cyberattacks. In a recent survey of finance and IT leaders, 40% of respondents noted enhanced security as a major outcome of adopting digital approaches. AP automation can help strengthen a company’s internal controls by automatically flagging suspicious activity and cross-checking vendor information.

6 key components to creating a roadmap for AP transformation

AP transformation is a complex business initiative that requires careful coordination. Follow these six steps to develop and execute a comprehensive plan for digitizing and optimizing your AP workflows.

1. Meet with the entire AP team to identify current challenges

Talk to your AP team to pinpoint inefficiencies within your existing processes. If your organization has digitized some AP processes but not others, now is the time to complete the process and harness the full benefits of digital transformation. Around 40% of organizations have only partially automated their AP workflows, according to MineralTree’s 8th annual State of AP Report.

2. Build the business case for AP automation

While the advantages of AP automation may seem self-evident, senior leadership isn’t always convinced. To sell your transformation plan to the C-suite, highlight strategic benefits like the potential for cost savings, enhanced efficiency, and improved vendor relationships. For more guidance, be sure to also check out this guide on how to build a business case for AP automation.

3. Research AP automation platforms

Automating the entire end-to-end AP process is important to reap the benefits of AP digital transformation. Select an automation platform that offers comprehensive features such as easy invoice capture, streamlined approvals, and robust ERP integrations that enable you to digitize your AP team’s entire workflow.

Did you know? MineralTree provides significant advantages, including minimal IT involvement, direct debit capabilities, and scalability.

4. Review integration requirements

Effective integration of your AP automation solutions with existing ERP systems is crucial. Look for a solution that offers a full integration via API or a file-based integration. API integrations, in particular, offer greater flexibility than a file-based integration approach. Relying on APIs enables seamless, real-time data flows and maximizes the benefits of automation.

Did you know? MineralTree offers integrations with a wide variety of ERP solutions, including NetSuite, Sage Intacct, and QuickBooks.

5. Leverage analytics

AP is already shifting away from its traditional reporting focus to take on a more strategic role. Digital transformation is the next step in this evolution, enabling AP teams to become more data-driven. With the time freed up from automating manual tasks, AP professionals can leverage analytics to optimize payment mixes, improve cash flow forecasting, or drive other strategic efforts that contribute to broader business goals.

6. Improve over time

Continuous improvement is key to maximizing the benefits of AP digital transformation. As new data is acquired, insights from analytics are used to refine processes and enhance decision-making over time.

Final thoughts

AP transformation is a strategic investment that enhances overall business efficiency, promotes transparency, and bolsters security. By following a detailed AP transformation roadmap, businesses can ensure a smooth transition to a more streamlined and strategic AP function.

Request a demo to learn more about how MineralTree’s tailored AP automation solutions can transform your finance team.

Frequently asked questions about accounts payable transformation

1. What is the accounts payable process?

The accounts payable (AP) process is a financial operation of a business that involves managing payments to vendors. It starts with the receipt of an invoice, which must be verified and approved to ensure accuracy and legitimacy. Once approved, the invoice is recorded in the accounting system and paid according to agreed-upon terms, such as payment deadlines and early payment discounts. AP processes must be carefully managed at every step to maintain effective cash flow, prevent fraud, and build strong supplier relationships.

2. What are the benefits of accounts payable transformation?

By automating and digitizing the AP process, businesses can process invoices faster, at a lower cost, and with fewer errors. Automation enhances transparency and control, enabling better cash flow management and financial forecasting. Additionally, automated AP processes support strong vendor relationships by ensuring timely and accurate payments and fostering trust between partners.

3. What are the signs that your business should automate AP?

Your business should consider automating its accounts payable (AP) processes if you observe signs of inefficiency, such as frequent late payments, duplicated invoices leading to overpayments, lack of visibility into invoice status, and high operational costs.

4. What steps of the AP process can be automated?

Almost all steps of the AP process can be automated to some degree. For example, invoice capture that combines optical character recognition (OCR) with human review can replace error-prone manual data entry tasks. Invoice approval workflows and payments themselves can also be automated for greater efficiency.