Today’s businesses rely on efficiency, and the accounts payable department is no exception. But many AP departments are weighed down by manual, outdated processes that not only impede payment processing, but expose the entire company to fraud risk and put strategic vendor relationships at risk.

Adopting the right end-to-end AP platform, however, can significantly improve accounts payable efficiency, reduce processing costs, improve control over outgoing cash flow, mitigate fraud risk, and improve internal accounting controls. In this guide, we outline an invoice-to-pay process that can help businesses like yours facilitate business to business (B2B) payments and streamline operations.

What is the Invoice Payment Process?

An invoice payment is a payment rendered to the supplier for goods or services received. The invoice payment is one of the last parts of the end-to-end AP process. It occurs after invoice approval and payment authorization. Suppliers may receive payment through a check, ACH payment, virtual card, or other method, described below.

What is Invoice-to-Pay?

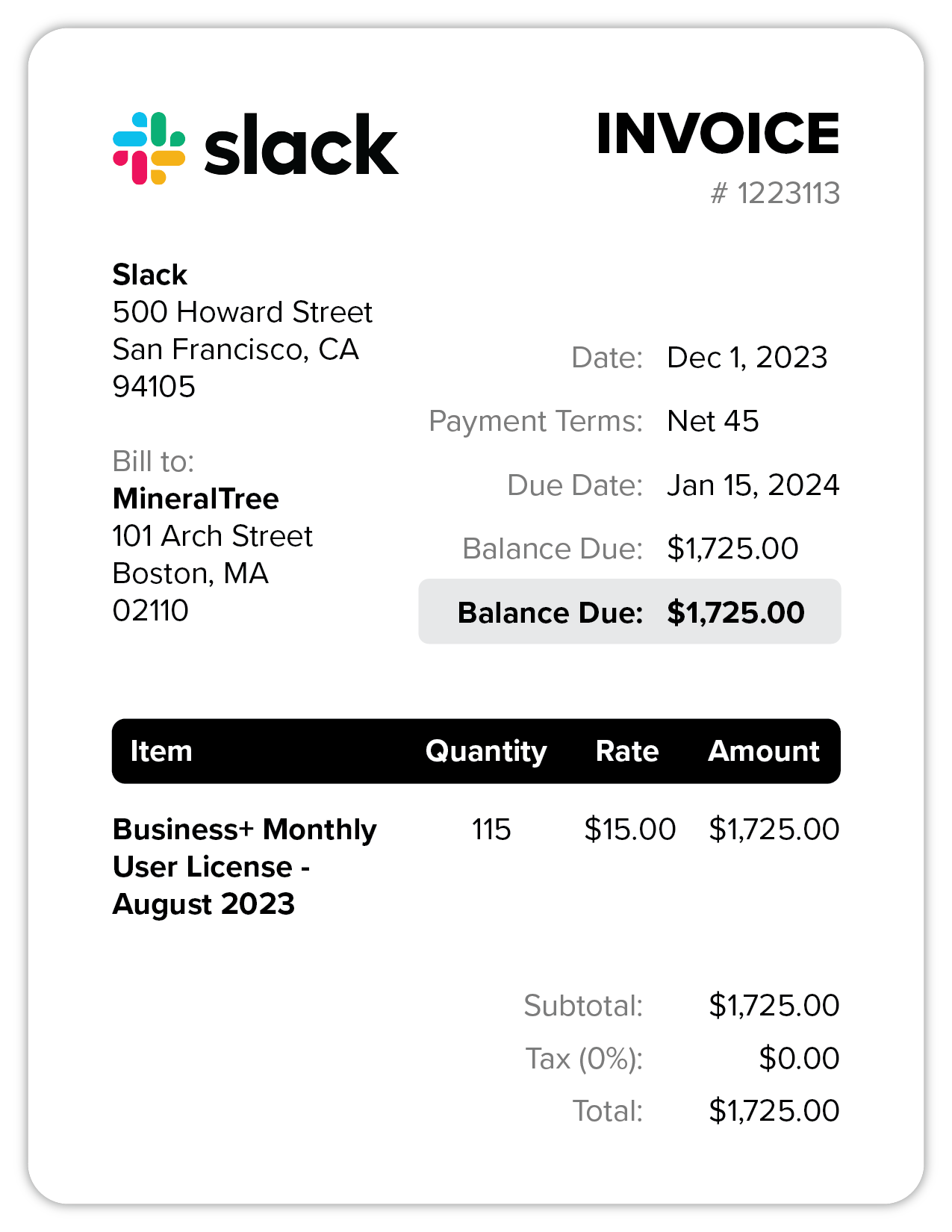

An invoice is a request sent by a supplier for payments of goods or services. When goods or services are rendered, the supplier sends an invoice detailing what was provided along with how much is owed, how to send payment, and when it is due.

When your organization’s AP department receives an invoice, this kickstarts the end-to-end AP process in which the invoice must be entered into the accounting system, where it is approved and authorized before payment is rendered. This process is often described as the invoice-to-pay workflow.

What Are the Steps in the Invoice Payment Process?

As described above, the complete invoice payment process starts with receiving the invoice and ultimately ends with payment. The 5 steps within the invoice payment process include:

- Invoice Capture

- Invoice Approval

- Payment Authorization

- Payment Execution

- AP Analytics

Let’s take a closer look.

1. Invoice Capture

First, the invoice is received. It may come via snail mail as a hard copy, or it may be faxed or attached to an email. It may also be received via a website portal. Once received, it must be entered into the AP system. This may be done manually by typing in the details, or some platforms with invoice capture capabilities automatically capture and code invoices from the scanned image.

If you use AP automation, then invoices received by email can be routed to a dedicated email address that triggers the capture process.

2. Invoice Approval

Once the invoice is in the system, the details and amounts must be checked and approved by the proper individuals. This may require coding for the right account, project, or cost center. If your business uses purchase orders, this may also involve PO matching. Manual means of invoice approval may require physically carrying an invoice from desk to desk to get signatures. Approval may also be handled via an email chain.

If your AP department uses automation, however, the approval process is simplified because approval requests are automatically routed to the right people along with the invoice and regular reminders if there is a delay.

3. Payment Authorization

Before payments can be made, they must be authorized. This is usually the job of a controller or CFO. As with invoice approval, the payment batch needs to make its way to this person for authorization. This can be done manually, via email, or with the help of AP automation.

Automation routes the payments and supporting information to the right person for authorization automatically. The payment approver gets notified of the pending payments they can review, approve, or reject.

4. Payment Execution

The fourth and final step for many AP departments is rendering the payment. Depending on your AP department’s processes and supplier preferences, payment may be sent via check, ACH, virtual card, or another method.

It’s important to note that manual payment processing–which involves printing, signing, stuffing, and mailing checks–is more likely to lead to missed or delayed payment because of the extra time involved and the fact that physical items can get lost in the mail. This leads to vendor dissatisfaction as well as lost opportunities for early-pay discounts. Automating payments and using electronic forms of payment almost always means everything happens faster and with fewer errors.

5. AP Analytics

If you use an AP platform that aggregates and renders data in real-time, you can add a 5th step to the process. The right analytics tools allow you to calculate key AP metrics automatically, such as invoice aging, the average cost per invoice, the rate of error, and more. This information enables data-driven decision-making and helps identify ways to improve efficiency, save money, and increase accuracy.

How to Make an Invoice Payment

In this modern era, many methods are available for paying invoices. If your AP department relies on manual processes, you may primarily send payment via check. If you use AP automation tools, you may have many more options at your disposal. Primary payment options include the following:

Check:

These must be printed out and mailed to the recipient, which can lead to delays. 33% of companies make more than 50% of their payments via check. However, checks do incur additional costs both for AP departments and your suppliers’ AR teams.

Virtual Cards:

These non-physical cards work similarly to credit card payments, but rely on a one-time use 16-digit code that authorizes only a specific payment amount, which makes them particularly secure.

ACH:

ACH stands for Automated Clearing House and refers to electronic network transactions made by financial institutions. With this method, funds are transferred directly between banks.

MineralTree’s AP solution helps organizations choose the most efficient payment methods for each transaction. We also work with vendors on your behalf to find the right payment method for them, and we handle their onboarding. Our solution supports all payment types including checks, ACH, virtual cards, and FX payments. Our virtual card payment method even allows you to create a revenue stream from cashback rewards.

What Are the Common Invoice Payment Challenges?

Many common challenges within invoice payments are largely dependent on the size or industry of a business. That said, some of the most common invoice payment challenges include:

- Missing invoices

- Duplicate invoices

- Missing data or information

- Errors on the invoice

- Matching invoices to purchase orders and receipts

- Recurring invoice mistakes

- Making timely payments

- Incorrect out of date, or missing contact information

- A large amount of supplier inquiries

Best Practices for Making Timely Invoice and Payments

Making invoice payments on time is a critical part of any business, especially when it comes to maintaining good supplier relationships and ensuring streamlined business operations. Here are some best practices to help your business make timely invoice payments:

1. Create a Clear Payment Process

Establishing a clear payment process starts by defining payment terms throughout your business. This includes clearly stating the payment terms on your invoices, stating due dates as well as any early-pay discount incentives for businesses to take advantage of. Creating a payment process also includes assigning a specific person to the team to handle invoice processing and payments. An effective way to ensure your payment process is organized is to set up automated email or SMS reminders for upcoming deadlines to avoid missed payments and late payment fees.

2. Streamline Invoice Processing

The easiest way to streamline invoice processing is to use an automated accounts payable system that has the capability to automate data entry and manage payments efficiently. Automating the invoice process can significantly increase business efficiency and accuracy, but choose software that provides an intuitive end-to-end workflow that’s highly configurable and optimized for every user role within your organization.

3. Take Advantage of Early Pay Discounts

Buyers may receive early payment discounts in exchange for paying a supplier’s invoice before the due date. By taking advantage of these early payment discounts, you can help to improve cash flow within your business, as well as strengthen relationships with vendors.

4. Ensure Effective Communication

Establishing effective communication starts by addressing inquiries as they come, regularly communicating with vendors about payment schedules or delays in the payment process, as well as maintaining open communication throughout your business as a whole. Doing so will help to establish transparency, build trust, help resolve issues quickly, as well as ensure everyone is on the same page within your organization and across your scope of vendors.

5. Leveraging an AP Automation Solution

AP automation will help to streamline your entire invoice-to-pay process, ensuring your business makes payments on-time, stays organized, and promotes strong relationships with vendors. In addition, many AP automation solutions, like MineralTree, also offer analytics that can help to identify bottlenecks within your AP process, determine unnecessary costs, identify your business’s cash flow, as well as promote healthy supplier relationships.

What Are the Benefits of Paying Invoices On Time?

Paying your invoices on time is essential to maintaining good cash flow and strong supplier relationships. On top of that, paying invoices on time will allow your business to take advantage of early pay discounts. Timely invoice payments can also make the AP end-of-month process quicker, making it easier for teams to gain insight into the financial health of the company.

How Can Businesses Automate Invoice Payments?

Businesses can automate invoice payments in various ways, but true end-to-end accounts payable (AP) transformation requires integrating the right automation solution with the ERP or accounting system. When evaluating solutions, consider your existing business rules, approval workflows, and internal controls and how they would work in an automated environment.

What Are the Benefits of Automating Invoice Payments?

Automation is the way of the future. Businesses that continue to rely on manual processes will be quickly surpassed by those who adopt solutions that leave them more flexible and agile while improving efficiency. Among the benefits of automating your invoice-to-pay process are the following:

- Cost savings

- Time savings

- Improved accuracy

- Strengthened supplier relationships

Cost Savings:

Only 13% of financial professionals estimated that their payment process costs them over $10 an invoice. However, as the American Productivity & Quality Center notes, invoices cost on average, $12 to process. Invoice processing continues to silently eat away at the bottom line of most businesses.

Automation lends itself to more electronic payment options, which are less expensive to process than paper checks. The cost of processing a paper check is about $5.00 per payment. This includes time costs such as collating these checks, and hard costs, such as stamps and envelopes. By using e-payments instead of paper checks, your company can easily save thousands of dollars annually.

The use of virtual cards also allows you to capture cash-back rewards, and processing payments faster means you can also snag early payment discounts.

Time Savings:

Traditionally, AP teams spend vast amounts of time capturing, coding, and managing invoice approvals. Because the automation software does a lot of the repetitive work for you, your employees have time to spend on higher-value tasks.

Using automation, you can streamline the process of manual tasks such as capturing, coding, and approving invoices and matching POs. In today’s hybrid work environment, having a system that does not rely on paper processes can also future-proof your business.

Improved Accuracy:

Since most things are handled by machines, there is less room for human error, including typos, incorrect amounts, or invoices getting lost in the approval process. Improved accuracy also helps teams improve their relationships with their vendors and reduces time spent managing invoices.

Improved ERP Syncs:

The best automated AP processes include automatic, two-way syncing with the ERP system, further reducing error. MineralTree’s TotalAP supports direct integration with the world’s leading ERPs, such as Oracle (NetSuite, EBS, ERP Cloud, JDE, PeopleSoft); SAP; QuickBooks (Desktop, Online); Microsoft Dynamics (Business Central, Great Plains, Finance & Operations); and Sage (Intacct, 50, 100).

Enhanced security:

With less room for humans to intervene and ample security controls in place, automation often reduces fraud and other security risks. Two-factor authentication, segregation of duties, and tokenization are all part of an automated AP process and add an extra level of protection to the invoice payment process.

Strengthened supplier relationships:

Most businesses surveyed (71%) note that supplier relationships have became more important over the last year. For organizations related to healthcare, this number was even higher (75%).

You’ll keep your suppliers happier by ensuring their payments are processed efficiently. Many platforms also include a vendor self-service portal that provides visibility into the status of their invoices and payments, keeping them in the loop.

Final Thoughts

Manual AP processes are inefficient, expensive, and error-prone. Moreover, reliance on paper checks often leads to missing early-pay discounts, rebates, and other opportunities to save money. If you want to improve your invoice-to-pay process, consider adopting

MineralTree’s TotalAP solution. Our solution automates your end-to-end AP process, from invoice capture through payment, while providing KPIs and analytics tools to help your organization’s leaders make data-driven decisions.

Learn how MineralTree can help your organization adopt automation and streamline your invoice-to-pay processing today.

Invoice Payment FAQs

What is the Difference Between a Paid Invoice and a Payment Invoice?

A paid invoice is an invoice that has been paid or settled by a customer, while a payment invoice is a type of invoice that is used to request payment from a customer — traditionally for goods or services they received.

What Are Common Invoice Payment Terms?

Some of the most common invoice payment terms that are used include:

Net 30, Net 60, and Net 90 are all very common payment terms with suppliers. However, the following may also appear on an invoice:

- Cash on Delivery (COD)

- 21 MFI (21st of the Month Following Invoice)

- EOM (End of Month)

- Upon Receipt

- Discounts for Early Payment (ie. Net 30/10, Net 15 EOM/5)

What Are the Differences Between Bills and Invoices?

While both bills and invoices are used to request payment for goods or services, bills provide limited details (such as prices and tax), while invoices provide detailed information of the goods or services provided. The purpose, content, legality, payment terms, and timing are also factors what differentiates a bill from an invoice.

What’s the Most Secure Way to Pay an Invoice?

Businesses can securely pay an invoice with ACH transfers and checks, but virtual cards are the most secure. Virtual cards are non-physical cards that work similarly to credit card payments but have a one-time use 16-digit code that authorizes only a specific payment amount, which makes them particularly secure compared to other payment methods.

What Are Bill Payments?

Bill payments refer to the process of paying or settling your outstanding debts for services or goods you or your business has received.

What is the Best Way to Pay an Invoice?

It’s best to pay suppliers in their preferred format when possible. With an automation tool like MineralTree, vendors can receive payment in their preferred method, without creating additional workflows for your team. If suppliers accept digital payments, these tend to be more secure than paper-based checks. Additionally, teams can take advantage of rebates when using virtual cards.

What Are the Different Ways to Pay an Invoice?

There are many different ways to pay invoices. If your accounts payable department relies on manual processes, you may primarily send payments by check. However, if you use AP automation tools, you will have many more options at your disposal including virtual card, check, and ACH.

What Are the Consequences of Not Paying an Invoice on Time?

Late, or overdue payments, can have a huge impact on businesses of any size. Not only do they cost your business money in the form of interest and fees, but they can also hurt your reputation with suppliers and other business partners.

How Can I Automate Invoice Payments?

Businesses can automate invoice payments by leveraging an AP automation solution, like MineralTree, which helps teams process vendor payments more quickly and efficiently. MineralTree offers a unique combination of easy-to-use software and managed services that can help you achieve a faster ROI on automation and direct two-way sync with several popular accounting systems.