Payment Tokenization Explained

What is Payment Tokenization?

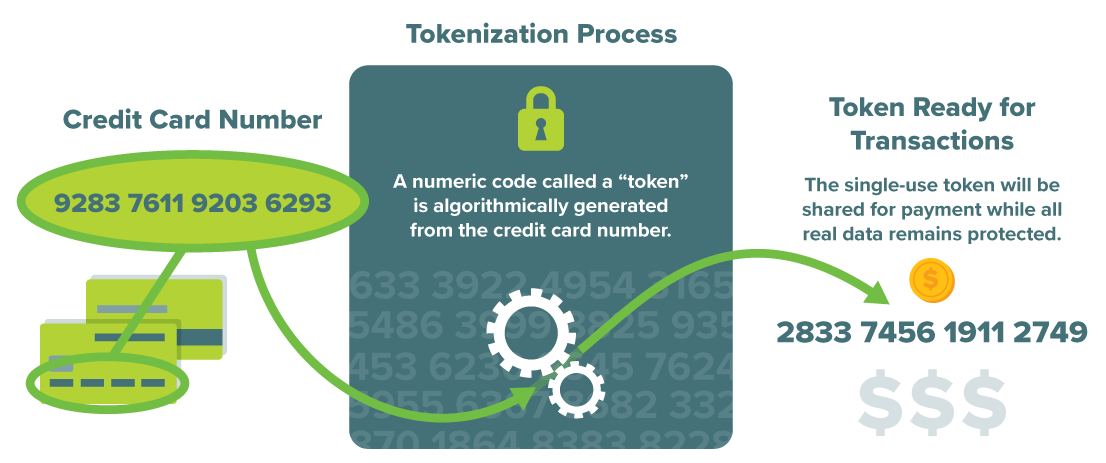

Payment tokenization is the process of protecting sensitive credit card data by replacing it with a randomly generated, 16-digit number called the “token.” Payment tokenization is designed to protect against online or digital security breaches by ensuring that payments can only be charged one time, often only for a specific amount, and that all static credit card or account information is concealed throughout the entire payment process.

Electronic payment methods, such as virtual cards, leverage payment tokenization technology to provide a payment method that is faster and more secure than check and ACH, and that fits seamlessly into your current AP workflow.

How does Payment Tokenization work?

Similar to the way the chip on your physical credit card protects against fraud during a physical purchase, payment tokenization defends by adding an additional layer of security to all digital transactions. With tokenization, your PAN (primary account number) is substituted with an algorithmically generated series of characters that prevent any actual credit card or account details from being exposed. Individual tokens are completely anonymous, can only be charged once by a vendor, and often only for the specified amount.

Armed with the knowledge that tokens can only be charged one time for a specific amount and that tokenized data is not mathematically reversible, your business can feel good delivering a unique token to vendors by email to process just like a credit card, without risking payment security.

Payment Tokenization vs. Encryption

Encryption is a security tool that involves the transformation of data, making it unreadable to anyone without the decryption key and an algorithm to decipher. The core issue with encrypted data is that it is designed to be restored to its initial, unprotected state. Unlike data that is encrypted, tokens are not able to be mathematically reversed or reconstructed into the original data. This means that these payment tokens hold no real value should they be intercepted.

While both encryption and payment tokenization are excellent tools for defending against credit card fraud, it would be a mistake to confuse the two. An increasing number of organizations are embracing payment tokenization as a more secure, more cost-effective way to safeguard account information.

Examples of Payment Tokenization

From a consumer standpoint, we have already seen how payment tokenization has been applied in mobile payment services such as Apple Pay, digital payment apps like Venmo, and even booking services and eCommerce sites with one-click checkout such as Uber and Amazon.

However, we are also seeing payment tokenization applications increase in B2B settings. A prime example is MineralTree’s own SilverPay, a fully plastic-less virtual card that sets up each payment with a randomly generated card number that can be charged one time for one specific amount. In addition to mitigating the risk of payment fraud, SilverPay improves your command over cash flow and provides cash-back rebates on all virtual card payments.

Many businesses are also making use of tokenized payments for their existing bank-issued corporate cards. In addition to being able to make standard payments using your physical card, these cards allow you to generate tokenized numbers for supplier payments as part of your AP workflow.

Benefits of Payment Tokenization

Employing payment methods that use tokenization will make the process of sending and accepting payments easier and more secure. Benefits of payment tokenization include:

- PCI Compliance: Payment tokenization eliminates a business’s need to store customer, vendor, or merchant’s payment information directly.

- Increased Security: According to AFP’s “Payments Fraud and Control Survey Report,” checks and wire transfers are the payment methods most impacted by fraud activity.

- Streamlined Payment Process: The use of payment tokenization can help to replace cumbersome paper checks and the inefficient manual processes associated with them.

- Greater Visibility into Working Capital: Tokenized payments are immediately debited into the recipient’s account, opening opportunities for early-pay discounts and minimizing float windows.

- Widely Accepted: Because tokenized payments are processed like a standard credit card, more than half a million vendors have opted in to accepting virtual card payments from MineralTree.

- Assurance of Payment: The immediacy of payment deposited directly into vendor accounts and electronic remittance detail gives vendors complete assurance throughout their AP process.

Tokenization plays a crucial role in the security of an accounts payable process, helping to protect sensitive information, preventing data breaches, and deterring hackers. This is because tokenization is more than just security technology, it is a key part of creating smooth and secure payment experiences for both businesses and vendors. Want to learn more about how your AP process can be more sophisticated in its fight against cyber-attacks, more streamlined end-to-end, or generate more revenue with virtual cards?