Manual invoice approvals are tedious and time-consuming. They require accounts payable (AP) teams to waste valuable time chasing down signatures, following up with stakeholders, and sifting through paper invoices. The result? Duplicate payments, delayed vendor settlements, and disparate invoices in multiple formats.

Digital transformation significantly shifts how businesses handle invoice workflows, particularly as more AP teams turn to cloud-based invoice approvals. By digitizing this process, AP teams can save time, reduce errors, and increase efficiency—allowing organizations to reallocate resources toward higher-value projects while ensuring invoices get paid promptly.

Despite these benefits, nearly 30% of companies have not yet automated their invoice approvals, according to MineralTree’s 8th annual State of AP Report. Businesses that stick to manual, outdated approval processes are missing out on the potential to streamline the payment processes and wasting valuable time that could be better spent on strategic financial operations and business growth.

Key takeaways

- By eliminating cumbersome paper-based review, approval, and processing, cloud-based invoice approval can save time, reduce errors, and increase efficiency.

- Cloud-based invoice approval processes open new business opportunities and benefits, from streamlined workflows and automated tools to enhanced visibility and fraud protection.

- With digital invoice approval, businesses can move toward automating the end-to-end AP process from capture and approval to payment—bringing financial operations in line with the digital business landscape.

An overview of cloud-based invoice approval

Invoice approval is the process of reviewing, approving, and processing invoices for payment. This process typically involves several steps, depending on a company’s financial policies, accounts payable procedures, and the type, quantity, and complexity of purchased goods or services.

In manual approval processes, AP teams must email or directly deliver invoices to get approval from the stakeholders most familiar with each account. They then have to track each invoice against payment deadlines to ensure stakeholders review and provide sign-off in time.

Digital invoice approval digitizes and automates this process, eliminating the paper-based distribution and manual collection of invoices. With a digital approval workflow, AP teams can manage real-time payment schedules and grain transparency into operational budgets.

The advantages of cloud-based invoice approval

Transitioning to a paperless approval workflow significantly improves the AP processes—opening up opportunities to achieve greater efficiency, productivity, and accuracy across financial operations. With a cloud-based invoice approval workflow, businesses reap significant advantages, including:

1. Ability to approve invoices from anywhere

The inherent flexibility of cloud-based systems means that invoices can be accessed, reviewed, and approved from anywhere at any time.

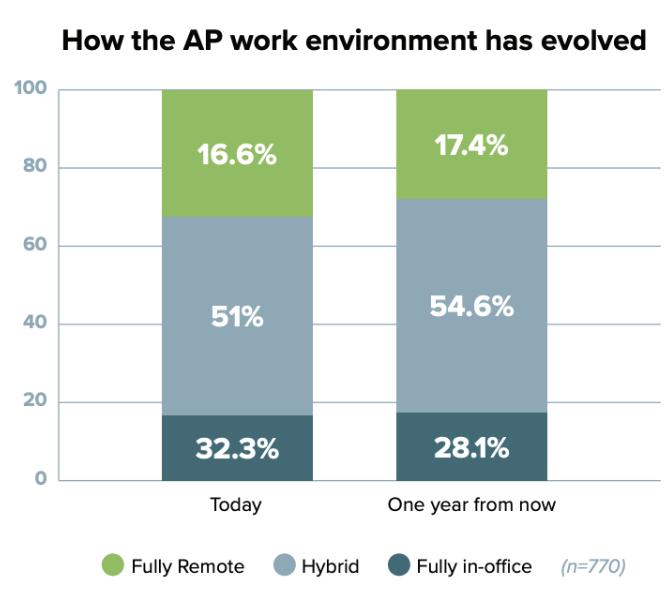

This capability is particularly beneficial for today’s remote and hybrid teams. Research from the State of AP Report found that 67% of AP departments are either hybrid or fully remote, and more than 80% of teams will be one year from now. By integrating cloud-based invoice approval solutions, organizations can ensure seamless financial operations irrespective of geographical and logistical barriers.

Did you know? MineralTree’s paperless invoice approval system enables decision-makers to sign off on invoices with just a click of an email, eliminating the need for cumbersome back-and-forth communication and stacks of paper.

2. Improved visibility

One critical drawback of paper-based processes is the lack of transparency in tracking invoice status. Paperless approval systems solve this challenge by providing real-time insights into the invoice lifecycle, enhancing the ability of AP teams to manage workflows and identify bottlenecks. This increased visibility helps expedite the entire invoice approval process.

3. Automated follow-ups

Timely invoice approval is crucial for maintaining cash flow and strong vendor relationships. Cloud-based systems can automate the follow-up process, sending reminders to approvers to ensure invoices are promptly handled. This automation significantly reduces errors and delays and eliminates the need for manual intervention.

Before implementing AP automation, Positive Coaching Alliance faced challenges regarding invoice approvals. As Judy Dillenbeck, senior accountant at PCA, noted, “We receive over 200 invoices a month, each of which is associated with a different location and approver. When an invoice was received, I would need to track down the appropriate approver. I was spending a lot of time contacting Directors to get them to approve an invoice.” A cloud-based platform allowed their team to streamline approvals better while providing more visibility into the process.

Did you know? AP automation tools like MineralTree directly route invoices to the right stakeholder for approval and schedule follow-up reminders as needed.

4. More timely payments

Cloud-based systems expedite the payment process by enabling quicker invoice approvals and fewer delays. This speed is crucial for maintaining good vendor relationships, especially when supply chain disruptions demand swift payment responses. In fact, 87% of AP teams say the speed of payment is important to their suppliers.

With manual AP approval processes, invoices can get lost on someone’s desk or email inbox, delaying approval and payment. Automation software empowers AP teams to foster strong relationships with key business partners.

5. Better fraud control

Manual AP processes are prone to invoice fraud and security risks. With so much paperwork, there’s always a risk that fraudulent activity will go undetected. Cloud-based solutions mitigate these risks by implementing stringent verification and authorization checks that validate each invoice. Automated checks occur before an invoice affects the general ledger, allowing discrepancies to be identified and addressed early in the process.

Digital trails also ensure that all transactions are transparent and auditable. This proactive approach prevents fraud and helps businesses comply with stringent regulatory standards.

Did you know? MineralTree’s invoice approval systems incorporate enhanced security measures, such as encryption and multi-factor authentication, to safeguard sensitive financial data against unauthorized access.

6. Efficient paperless workflows

Cloud-based invoice approval is one step toward a fully paperless end-to-end AP workflow. It can be the starting point for organizations to automate the entire AP process, from capture and approval to payment. End-to-end AP automation and digitization streamline processes, improve accuracy, and enhance visibility across the entire AP workflow.

Case study: AP automation becomes a business advantage for Affinity Dental

Affinity Dental Management is a dentist-run dental service organization (DSO) that provides comprehensive practice management and administrative support services for practices across the northeast United States. As the organization grew, so did the amount of invoices their small team had to manage.

Seeking a solution, the finance team turned to MineralTree for its seamless integration with QuickBooks and cloud-based AP capabilities. By implementing MineralTree, Affinity Dental was able to streamline workflows, freeing the team from manual tasks. It became more than an AP automation tool for the company—it’s a solution that lets them manage their business more effectively.

Final thoughts

Cloud-based invoice approval is a strategic move that bolsters your organization’s financial health and supports high-level business objectives. When you make the move to AP automation, you experience immediate operational benefits and pave the way toward automating the entire AP workflow.

MineralTree offers a scalable cloud-based solution that seamlessly integrates with various ERP systems, allowing you to transition smoothly from traditional to digital AP processes.

Learn more about how MineralTree’s solutions can help your business automate AP processes and achieve a streamlined, paperless financial environment.

Cloud-based invoice approval FAQs

1. What is the invoice approval process?

The invoice approval process involves reviewing, validating, and authorizing invoices before payments are processed, ensuring that all expenditures are accurate and justified.

2. What steps are involved in the invoice approval process?

The steps typically include receiving the invoice, verifying details against purchase orders, obtaining necessary approvals from relevant stakeholders, and scheduling payments.

3. Does QuickBooks have an invoice approval system?

While QuickBooks offers basic AP workflow functionalities, it lacks the advanced features necessary for modern operations. For instance, Quickbooks requires teams to enter and code vendor invoices manually; approvals outside of QuickBooks typically require cumbersome tracking through email, chat, or post-approval attachments. Integrating with solutions like MineralTree can enhance the QuickBooks AP workflow by automating approvals and improving overall efficiency.

4. Does NetSuite have an invoice approval workflow?

Oracle NetSuite provides a comprehensive cloud-based ERP system that includes invoice approval capabilities. However, customizing the process can be challenging. Implementing MineralTree simplifies and optimizes the NetSuite invoice approval workflow to maximize ROI.