While the cloud isn’t a new phenomenon, the past few years have accelerated cloud adoption for many businesses aiming to manage their processes more efficiently.

Accounts payable is no exception to this shift, as cloud technology has emerged as a cornerstone for financial operations. Organizations can achieve significant operational efficiencies, reduce costs, and support a more agile workforce by transitioning from desktop or premise-based software tools to a cloud-based accounts payable solution. This blog is your complete guide to cloud-based AP.

Key takeaways

- Desktop accounts payable solutions and premise-based ERPs place the responsibility of data security and system updates on the user, and they do not accommodate remote and hybrid teams.

- Cloud-based accounts payable solutions use public or hybrid cloud infrastructure, enabling finance teams to manage their AP processes from anywhere.

- Managing the AP process with a cloud-based system empowers teams to embrace a paperless AP approach, enhance security, and automate tasks for greater efficiency. It provides a bridge to cloud-enabled workflows even if their accounting system is premise-based.

What is cloud-based accounts payable?

Cloud-based accounts payable refers to the management of an organization’s bills and payments through digital, internet-hosted platforms. Cloud-based accounts payable solutions enable businesses to process, approve, and pay invoices online, allowing AP teams to facilitate seamless financial transactions from anywhere. Cloud-based AP tools can include ERPs, accounting software, AP automation solutions, or point solutions addressing specific challenges such as invoice capture, document management, or digital payments.

A digital approach to AP enhances the efficiency of these processes and provides organizations greater visibility into—and control over—their financial operations.

Types of cloud-based AP

Discovering the right cloud environment for your business is similar to finding the perfect office space. Cloud-based AP solutions offer different options to meet your organization’s specific needs, like choosing between a shared office or a private suite. Whether you’re looking for flexibility, control, or a mix of both, understanding the variations within the cloud can help you make the best choice for your AP processes. Let’s take a deeper dive into the three types of cloud-based AP software below.

1. Public cloud

Cloud-based AP solutions hosted in the public cloud are like renting office space in a shared building. They offer accessibility over the internet, flexibility, and cost-effectiveness without needing your own infrastructure.

2. Private cloud

Private cloud AP solutions provide dedicated environments for your AP processes, similar to having a private office suite. They offer more control and customization options, making them ideal for specific security or compliance needs.

3. Hybrid cloud

Hybrid cloud AP solutions combine the benefits of public and private clouds. You can keep sensitive AP data in your private space while using shared resources for less critical tasks, offering control and flexibility.

Trends Related to Cloud-Based AP Software

Investments in cloud-based services have continued to grow. Gartner has noted that cloud-based services will shift from being disruptors to being a business necessity by 2028. “While many organizations have started to seize the technical advantages of cloud, only a few have unlocked its full potential in supporting business transformation,” Milind Govekar, Distinguished VP Analyst at Gartner, said. “As a result, organizations are using the cloud to launch a new wave of disruption driven by artificial intelligence (AI), enabling them to unlock business value at scale.”

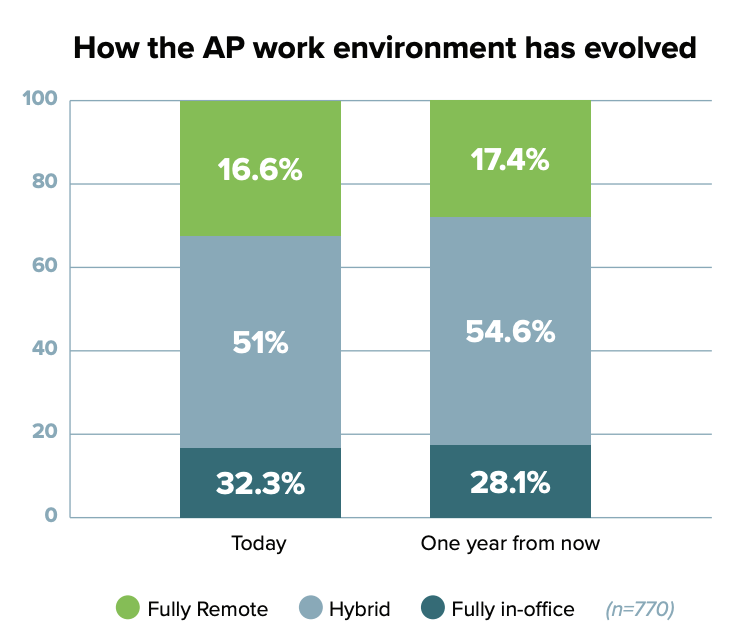

The COVID-19 pandemic has also shifted the workplace, with many offices embracing a fully remote or hybrid model. In fact, 67.6% of financial professionals noted that they are either remote or hybrid, and 72% expect that to increase over the next year. Unfortunately, On-premise solutions cannot effectively equip this kind of office structure.

The shift to cloud-based solutions can also be seen across industries and ERP systems. When NetSuite was launched as NetLedger in 1998, it was a web-based tool with the goal of replacing disconnected systems. In alignment with NetSuite’s vision to become a cloud-based solution, Oracle purchased the company in 2016. Unlike other ERP tools, NetSuite only has a cloud-based model.

Sage has also focused more heavily on the cloud in recent years, especially with the development of its Digital Network, which is meant to serve all product lines and help customers transition to the cloud. This approach will allow Sage to roll out functionality and tools more easily across customers.

Despite this shift to the cloud, many ERP customers are still reluctant to migrate due to data loss concerns or the overall transition costs, as was evidenced by SAP’s announcements related to its cloud-first model. For companies not yet ready to adopt a cloud-based ERP, integrations with cloud-based tools can allow teams to reap the benefits of a web-based tool while still working with on-premise applications.

Cloud vs. desktop AP tools

The debate between cloud vs. desktop AP tools often revolves around accessibility, security, and pricing models.

Cloud-based solutions leverage public or hybrid cloud infrastructure to offer users real-time access from any location. With cloud-based AP solutions, it’s up to both the software provider and the end user to implement measures that secure data and ensure its integrity. Frequent, provider-managed software updates help to make cloud-based systems highly agile and able to adapt to change. Users of cloud-based solutions also typically pay on a subscription basis, a pricing model that reduces upfront costs.

Conversely, desktop or on-premise solutions place the onus of software updates and security entirely on the end user. Desktop solutions often require a significant initial investment and ongoing IT resources to manage. While both cloud and desktop solutions have their merits, the flexibility and scalability of cloud platforms are increasingly making them the preferred choice for modern businesses.

Key differences between cloud and on-premise/desktop

Below are key considerations to take into account when comparing the two solutions.

| Cloud | On-premise/desktop | |

| Updates | Managed by cloud providers: frequent updates without downtime or AP workflow disruption. | The organization is responsible for software updates. |

| Security | More secure due to frequent and automatic updates; security becomes a shared responsibility between client and provider. | The organization is responsible for security, including patching. |

| Price | Billed as a subscription service: ongoing costs but fewer upfront costs. | May have higher upfront costs and require ongoing IT assistance. |

Top 9 benefits of a cloud-based accounts payable solution

Cloud-based accounts payable solutions offer a number of benefits to your AP team and organization, supporting a more efficient and effective AP process, including:

1. Paperless AP

2. Invoice approval from anywhere

3. Direct integration

4. Accessibility for remote and hybrid teams

5. Enhanced security

6. Better document management

7. Boosted efficiency

8. Fewer manual tasks

9. Scalability

Keep scrolling for a deeper look at each benefit.

1. Paperless AP

Shifting to a cloud-based AP system can save considerable cost and time. A paperless AP process enables your team to cut down on printing, mailing, and storage expenses—and the manual effort required to complete those tasks.

Moreover, the transition to paperless operations inherently improves data accuracy. Digital invoicing and payments minimize human error associated with manual data entry and the physical handling of paper documents.

2. Invoice approval from anywhere

The mobility afforded by cloud-based systems enables managers and approvers to review and approve invoices from anywhere. As a result, you can ensure your payments are processed without delay, helping you avoid late payments and even capitalize on early payment discounts.

Additionally, cloud-based AP solutions offer greater control over pending approvals and financial obligations. Increased visibility into these operations helps you facilitate better cash flow management and financial planning.

3. Direct Integration

Cloud-based AP tools with a direct integration will provide a two-way sync, so your ERP tool will remain the system of record. Cloud-based solutions with direct (API-based) integrations can feed information into and pull from a central database to ensure there’s only one single source of “truth.” This model also allows finance teams to automate the invoice-to-pay cycle using integrated cloud-based tools for true digital transformation.

Additionally, direct integrations can make the shift from on-premise to cloud-based solutions easier. Since ERP migrations can take months to complete, teams can still reap the benefits of a cloud-based solution while working with an on-premise solution such as QuickBooks Desktop.

Did you know? Not all integrations are created equal. While some AP tools may promote a two-way sync, some tools have a sync that operates better in one direction than the other. When looking for a partner, be sure that the integration is a true bi-directional sync.

4. Accessibility for remote and hybrid teams

Your remote and hybrid team members must be able to access documents and other data as quickly and easily as employees in the office. Cloud-based AP solutions offer users the ability to access, share, and process documents in real-time from anywhere, facilitating easier collaboration across distributed teams.

This is especially critical because, according to the State of AP Report, 67.6% of AP work environments are hybrid or fully remote, and 82.7% of teams will be hybrid or fully remote one year from now.

5. Enhanced security

The right cloud-based solution providers protect your data through robust security measures like encryption, intrusion detection systems, and multi-factor authentication. These defenses help defend sensitive financial data against unauthorized access and may also aid compliance with regulatory standards.

In addition, backing up your data to the cloud lets you create a reliable disaster recovery plan and ensure business continuity in the event of system failure or data loss.

6. Better document management

Cloud-based AP systems’ sophisticated document management capabilities allow for efficient categorization, tagging, and searching of invoices and payment records. This level of organization makes it easy to retrieve financial records, which is crucial for audit preparation and compliance checks.

Additionally, these solutions maintain all documents in a centralized cloud repository, facilitating version control and ensuring that teams always work with the most up-to-date information. This approach minimizes the risk of discrepancies and promotes consistency across financial operations.

7. Fewer manual tasks

Automation of invoice processing and payments through cloud-based AP solutions minimizes the need for repetitive, manual tasks like data entry. This decreases the likelihood of errors and promotes more accurate financial reporting and analysis.

Eliminating this manual work also frees up staff. As a result, your team can reallocate resources to strategic initiatives that contribute more directly to growth and innovation.

8. Boosted efficiency

Investing in cloud-based AP automation can significantly raise the efficiency of your entire AP process. The right solution enables you to automate and streamline the entire AP workflow, enabling your team to process more invoices faster while offering advantages like increased visibility. As a result, you can enhance the efficiency of your financial operations from invoice capture to final payment.

9. Scalability

Cloud-based tools can make it easier to scale your operations while accommodating future growth. This kind of software also requires fewer internal IT resources since the provider manages patches or updates.

Did you know? Some cloud-based solutions pay per user, which makes it difficult for teams to collaborate. Finance teams should consider their growth trajectory when looking at pricing and whether they need to pay for additional users. Alternatively, they can partner with a cloud-based tool that charges based on the number of invoices, so their team can easily collaborate without needing additional seats.

Checklist: 8 Steps to finding the right cloud-based AP solution for your organization

Selecting the right AP solution is critical for organizations to streamline their financial processes and increase efficiency. Use the checklist below to help get the selection process started.

✔️1. Assess your current AP process

Start by thoroughly assessing your current AP process and identifying pain points, inefficiencies, and areas for improvement. Consider factors such as manual tasks, paper-based processes, processing times, and compliance requirements.

✔️2. Define your requirements

Clearly outline your AP requirements and objectives. Identify the features and functionalities you need in a cloud-based AP solution, such as:

- True bi-directional syncing

- Accurate invoice capture

- Easy invoice approval process

- Ability to scale

- Comprehensive reporting and analytics

- Offload vendor virtual card enrollment

- Multi-currency payments

Check out the blog How to Choose the Best Accounts Payable Software Solution for a deeper dive into the features and functionalities listed above.

✔️3. Research solutions

Research the market to find cloud-based AP solutions that meet your requirements. Look for solutions that offer benefits such as increased efficiency, cost savings, improved accuracy, and enhanced compliance. Also, explore vendor websites, customer reviews, and industry reports to create a list of potential options.

✔️4. Evaluate vendors

Request demos from vendors to further assess their offerings and evaluate the user interface, ease of use, customization options, and compatibility with your existing systems. Pay attention to factors like security measures, data privacy, and customer support.

✔️5. Consider integrations

Determine how the cloud-based AP solution will integrate with your existing accounting software, ERP systems, and other business applications. Ensure seamless data flow and compatibility to avoid disruptions in your current processes.

✔️6. Assess the total cost of ownership

Consider the TCO beyond the initial implementation cost. Evaluate factors such as:

- Subscription fees

- Per-user licenses (if any)

- Customization costs

- Training expenses

- Ongoing support

- Potential ROI from automation and efficiency gains

✔️7. Review compliance and security

Ensure your selected cloud-based AP solution complies with industry regulations and data security standards. Safeguard sensitive information by verifying the vendor’s security measures, data encryption protocols, access controls, and compliance certifications.

✔️8. Select your vendor and develop an implementation plan

Once you select your vendor, work with them to create a comprehensive implementation plan to ensure a smooth transition. To maximize adoption and minimize disruptions, you should:

- Define roles and responsibilities

- Allocate resources

- Schedule training sessions for users and/or get access to the knowledge center or any guided training courses

Cloud-based AP case study: MTB manages multiple entities with one platform

Montana Brands Management (MTB), a fast-growing franchisee, is committed to delivering exceptional service and customer satisfaction at its Taco Bell locations. Before the COVID-19 pandemic, MTB relied on a manual, paper-based approach for its AP process.

The company soon realized this was wasting precious time and resources. Investment in an AP automation solution was the obvious next step. As MTB evaluated vendors and products, it became apparent they needed an AP automation solution that could support remote workflows and approvals.

MineralTree’s cloud-based accounts payable solution did more than just meet this requirement. It also supported 50% growth in the number of invoices MTB processed by streamlining processes and enhancing overall productivity. Read the full case study here.

Final thoughts

Desktop AP tools once fulfilled organizations’ financial management needs. But it’s clear that modern businesses require the efficiency and agility of cloud-based solutions.

MineralTree’s cloud-based AP automation solution stands out by offering unlimited seats, allowing you to scale without worrying about additional costs per user. Additionally, MineralTree’s integration capabilities enable you to sync with a variety of ERP systems, including Sage Intacct and NetSuite. MineralTree also has integrations with on-premise solutions like QuickBooks Desktop, so you can reap the benefits of cloud-based AP regardless of your current system.

Ready to streamline your AP process? Schedule a demo today.

Cloud-based AP FAQs

1. Can you do accounts payable remotely?

Yes, you can do accounts payable remotely. MineralTree’s State of AP Report revealed that 67.6% of AP teams work in a hybrid or remote setting. Since remote teams find it more difficult to manually track down managers and approvers, automation with cloud-based AP solutions is particularly important to these teams’ success. Remote management of accounts payable is not only possible but also efficient—as long as you have the right tools.

2. What should teams consider when investing in a cloud-based solution?

There are several key considerations when investing in a cloud-based solution, including pricing models, invoice processing accuracy, and integrations. Many solutions charge you per seat, but others offer pricing models that will accommodate growth without additional fees for new users. While cloud-based AP solutions generally boost accuracy by reducing manual data entry, look for solutions that combine optical character recognition (OCR) with human review to minimize errors. Finally, choose a cloud-based solution that integrates easily with your existing ERP or other software.

3. What is the difference between cloud-based and server-based?

The main difference between cloud-based and server-based solutions lies in their infrastructure and accessibility. Cloud-based solutions offer remote access and shared security responsibilities, while server-based systems require on-premise management.

4. What are some web-based accounts payable software solutions?

Various ERP systems offer web-based AP functionalities, including Sage Intacct and QuickBooks. MineralTree’s AP automation solution enhances the capabilities of these solutions with advanced automation and integration features, boosting efficiency and productivity throughout the entire AP process.

5. What are the steps to choosing the right cloud-based AP solution for my organization?

1. Assess your current AP process

2. Define your requirements

3. Research solutions

4. Evaluate vendors

5. Consider integrations

6. Assess the total cost of ownership

7. Review compliance and security

8. Select your vendor and develop an implementation plan