Our recent 2022 State of AP report confirmed what finance leaders have known for quite some time: labor-intensive processing tasks are overwhelming AP departments without enough employees to help. Despite the pain, their workload continues to grow, with more companies processing greater payment volumes now than last year. It used to be that teams would solve this problem by adding more headcount, but in today’s economic and business climate that’s no longer a viable solution.

As the pressure mounts, AP teams, along with other departments across the organization, are losing staff due to the “Great Reshuffling” resulting from the pandemic. While Strategic Finance magazine identified AP as top priority for new hires, finding qualified candidates is no easy matter. In fact, more than half (54%) of companies planning to hire finance/AP professionals expect challenges and delays.

Rising wages is another key problem facing finance leaders. The cost for labor, which has increased by nearly 11% in Q2 according to the Bureau of Labor Statistics, is taking a bigger bite out of already-tight AP budgets. Factor in the potential oncoming recession, and even the teams that have found quality AP candidates may lose them due to hiring freezes beyond their control.

Despite all these challenges, the AP department’s work is essential to business continuity. Surprisingly, many companies still rely on time-consuming, manual methods to process invoices and payments. In fact, only 22% of respondents in our study have fully automated AP, while 37% have not automated at all. Slow, inefficient, error-prone manual processes can further slow down lean AP teams, and often lead to overdue payments and penalties – not to mention unhappy vendors.

Technology Helps Alleviate the Burden

Thankfully, there’s another, more effective approach to addressing the workforce shortage: AP automation. Instead of hiring more people to handle tedious tasks, teams can benefit from digitizing their manual processes and closing the open positions they’re struggling to fill.

Wondering where exactly digitization fits into your AP org? When it comes to automating an AP workflow, it’s most important for teams to strike the right balance between people and technology. The best way to do this is to look at the open positions to determine which can be offset with automation to create a foundation that supports scalable growth. Technology is better suited to handle repetitive tasks more accurately and quickly than people. For example, labor-intensive processing tasks – such as data entry, preparing payments, and routing invoices for review and payment authorizations – can be easily digitized to speed the process, reduce errors and costs, and provide visibility.

In turn, that frees up AP professionals to manage the more critical and strategic points in the process, such as invoice exception management, and payment authorization, as well as to focus on higher level activities, such as strengthening vendor relations, analysis, and identifying discount opportunities.

BrightView Easily Absorbs Increasing Invoice Volume with AP Automation

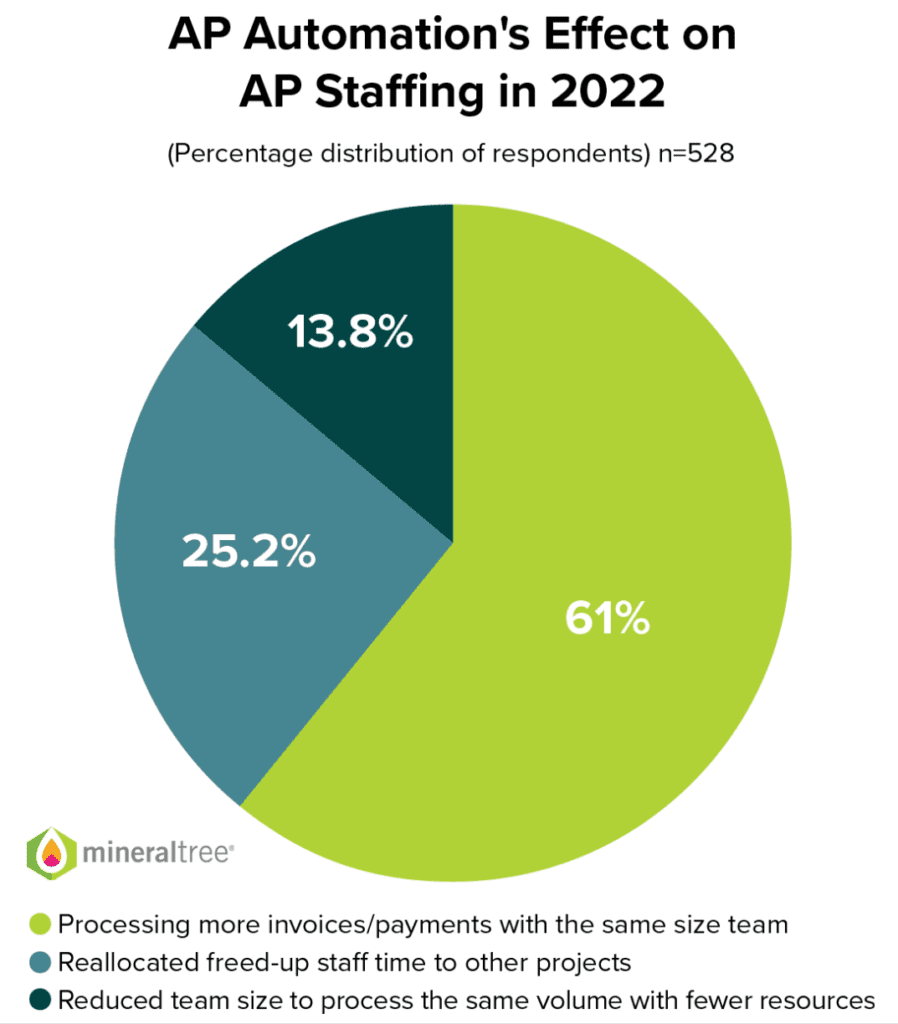

In the 2022 State of AP survey, 100% of respondents were able to overcome labor issues through automation. The majority (61%) of finance leaders increased their invoice volume using the same-sized team, others reallocated freed-up staff time to other projects (25%), while a small percentage (14%) chose to reduce their team size.

BrightView Health, an outpatient addiction treatment provider, provides a good example of how a company can use AP automation to process a much higher volume of invoices with existing headcount. BrightView’s invoice volume tripled due to corporate growth, making paper-based, manual methods no longer feasible. Thanks to AP automation with MineralTree, BrightView now manages three times its previous invoice volume without hiring more staff, and processes theirinvoices faster and more accurately than ever before.

Best Practices for Growing AP Departments

Forward-thinking finance leaders use a variety of strategies to achieve smooth-running AP operations despite the current labor shortage. Here are four best practices you should start implementing if you haven’t already:

1. Establish a Compelling Department Culture to Retain Staff

While finance may not be able to set the work culture tone for the entire company, it certainly can do so across its own department. Focus on developing the type of culture that will attract and retain top talent. Teams can do so by identifying, communicating, and living by core values that demonstrate integrity and establish trust. With so many employees working in remote or hybrid environments, it’s particularly important to offer team-building activities and opportunities for team members to connect regardless of whether they’re working from the office or their home.

2. Focus on the Employee Relationship

Leaders should routinely solicit employee input, and regularly communicate with staff to identify their needs, wishes, and concerns. Make sure to keep employees in the loop on department and company developments as appropriate.

3. Offer Top-Notch Benefits and Salaries

When the budget is available, teams should offer higher pay and benefits to lure top talent. But salary isn’t the sole focus of today’s candidates. Other benefits like flexible work schedules, including remote or hybrid work models, can be extremely attractive to potential hires.

4. Embrace AP Automation

In addition to alleviating the burden of manual processing, automation provides greater employee satisfaction. This is because it frees team members from low-level, repetitive and time-consuming tasks, so they can focus on more interesting, higher-level activities. According to an IOFM study, 47% of AP staff members feel that the tasks they are doing don’t make the best use of their abilities, and less than a third of them expressed strong job satisfaction. This demonstrates a key opportunity for finance departments to re-invision AP work for their staff and transform their work load from a manual set of tedious tasks into strategic projects that help the business grow.

Alleviate Hiring Challenges with AP Automation

Automation is a win-win scenario for companies and employees alike. It allows teams to manage a growing workload with the staff they already have, while also cutting costs, and reducing errors. Best of all, AP automation provides employees with a less stressful, more fulfilling work environment. In addition, by combining the visibility you gain from automation with analytics, you can find ways to strategically schedule payments, increase early payment discounts, and better manage cash flow. Automation not only enables AP teams to work faster, but also smarter and happier, thus creating the foundation for stronger, more resilient operations.

Are you curious to see AP Automation in action? Contact MineralTree or request a personalized demo.