What is Accounts Payable? (Definition, Process & Examples)

Accounts payable (AP) defined

Accounts payable (AP) is an accounting term used to describe the money owed to vendors or suppliers for goods or services purchased on credit. The sum of any and all outstanding payments owed by one organization to its suppliers is recorded as the balance of accounts payable on the company’s balance sheet, whereas the increase or decrease in total AP from the period prior will appear on the cash flow statement

It is important to pay close attention to your AP expenditures and maintain internal controls to protect your cash and assets and avoid paying for inaccurate invoices. Maintaining an organized and well-run accounts payable process is key so you remain aware of the effect AP has on your bottom line.

In this post, we answer the following questions:

- What is an accounts payable invoice?

- What is AP invoicing?

- What does accounts payable do?

- What is an example of accounts payable expenses?

- What is the accounts payable process?

- What is the invoice management process?

- What is the relationship between cash flow and accounts payable?

- What is accounts payable vs. accounts receivable?

- What’s the difference between accounts payable and trade payables?

- Is accounts payable a liability or an expense?

- Is accounts payable a debit or credit entry?

- How is accounts payable listed on a balance sheet?

- Why automate accounts payable?

Key takeaways

- Accounts payable (AP) is an accounting term used to describe the money owed to vendors or suppliers for goods or services purchased on credit.

- The accounts payable department provides financial, administrative, and clerical support to an organization.

- AP automation streamlines your accounts payable process from invoice capture to payment execution and keeps your information up-to-date and ready to use.

What does accounts payable do?

The accounts payable department provides financial, administrative, and clerical support to an organization. This team is responsible for managing the entire accounts payable process, which is critical to the company’s accounting branch and involves the coding, approval, payment, and reconciliation of vendor invoices.

Each responsibility of the accounts payable team helps to improve the payment process and ensure payments are only made on legitimate and accurate bills and invoices. A knowledgeable and well-managed accounts payable department can save your organization considerable amounts of time and money regarding the AP process.

Armed with automation capabilities, AP teams can easily decide when to pay invoices (to avoid late fees or capitalize on early pay discounts) and how to pay (via paper check, ACH, or through virtual cards where you earn cash-back rebates). Organizations, in turn, gain more control over outgoing cash and can even transform AP from a cost center to a profit center.

Important skills needed for accounts payable teams

There are a variety of skills an accounts payable team needs in order to have a successful accounts payable team. Some of the most important skills for AP team members include:

- Attention to detail

- Ability to manage numbers

- Manage important vendor relationships

- Clear communication skills

- Ability to work effectively with team members

- Knowledge of purchase orders

- Strong data entry skills

- Good time management skills

Selecting team members for your accounts payable department who possess these skills is important to guarantee the smooth and efficient operation of your organization’s AP department.

What are bills payable?

Bills payable refers to the liabilities that a business owes to its suppliers for goods or services provided that have not yet been paid for. These are usually short-term payment obligations that need to be settled within a certain time frame, depending on the terms negotiated with the suppliers.

What is accounts payable compliance?

Accounts payable compliance is the adherence of a business’s AP processes to relevant regulations, internal policies, and laws. Accounts payable compliance involves ensuring that all payment transactions (i.e. bills, invoices), made within the business maintain compliance with legal requirements and industry standards.

What is the standard operating procedure for accounts payable?

The standard operating procedure (SOP) for accounts payable refers to the step-by-step process for managing invoices, making payments, and handling other financial obligations within the AP process.

What is an example of accounts payable expenses?

Accounts payable differ from other types of current liabilities like short-term loans, accruals, proposed dividends and bills of exchange payable. Examples of accounts payable expenses may include (but are not limited to) things like:

- Transportation and logistics

- Raw materials

- Power / energy / fuel

- Products and equipment

- Leasing

- Licensing

- Services (assembly / subcontracting)

Should any of the goods or services listed above be purchased on credit by your organization, it is important to record the amount to AP immediately. This will ensure your balance sheet is kept up-to-date and accurately reports the total amount owed to your vendors, enabling transparency in your bookkeeping efforts and accounting process.

How to record accounts payable

When bookkeeping and recording in accounts payable, there must always be an offsetting debit and credit for all entries. When this is done for accounts payable, the accountant first credits the AP account when an invoice or bill is received. From there, the debit offset for this entry typically applies to an expense account representing the goods or services acquired on credit. Alternatively, the debit may be allocated to an asset account if the purchase entails a fixed asset. The accountant debits the AP account once the bill has been paid to reduce the liability balance. This debit is matched with a credit to the cash account, which then reduces the cash balance.

This meticulous recording in accounts payable ensures compliance with accounting standards and provides transparency and accuracy in a business’s finances. It also serves as a core step in maintaining robust financial management practices and facilitates informed decision-making by stakeholders.

What is the accounts payable process?

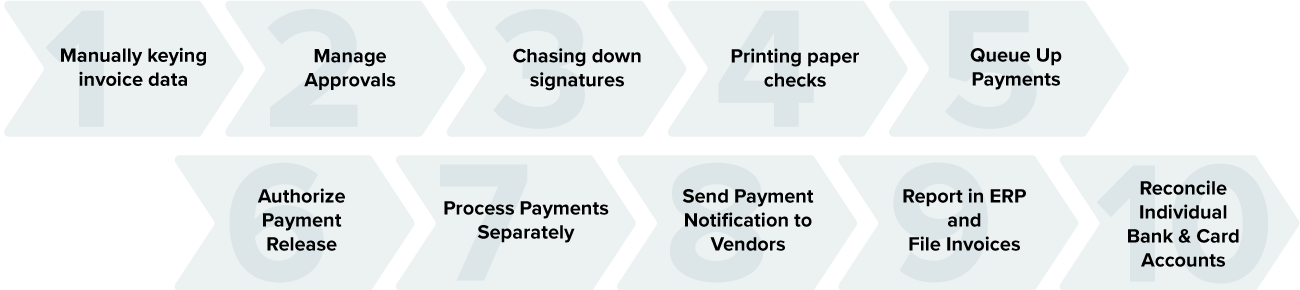

The accounts payable process manages a company’s financial obligations to its creditors and vendors. The end-to-end process of accounts payable includes four distinct steps:

- Invoice capture: Typically, invoice capture involves manually entering invoice data (vendor details, line items, amounts, and GL coding) into a system of record. This presents risks associated with accuracy and human error.

- Invoice approval: Invoice approval involves the review and approval of supplier invoices. Often, someone from the AP team literally walks the paper invoice around the office to obtain the necessary approvals. This happens prior to posting as a cost in the ERP and sending payment.

- Payment authorization: Once you have an invoice ready for payment, you must get authorization to make the payment. This includes the date you will submit the payment, the payment method, and the payment amount.

- Payment execution: Following payment authorization, the invoice is paid and remittance details are sent to the vendor. Oftentimes this involves printing, signing, and mailing checks, initiating ACH with the bank, or completing credit card payments. Now the invoice can be closed out of the system and filed into various repositories.

A manual, paper-based accounts payable process can result in inaccurate performance and financial reporting and prevent team members from working on higher-value activities that could contribute to your bottom line. Inefficiencies caused by inevitable human error can additionally result in late payments, missed opportunities (e.g., discounts for early bill pay), and inaccurate payments.

The manual AP process may also increase a company’s risk for AP fraud or business email compromise (BEC). For these reasons, having an up-to-date and well-run accounts payable team or system is important to ensure that your organization does not miss out on opportunities or report inaccurate financials.

Three major elements are typically required for execution within the accounts payable process: the purchase order (PO), receiving report (or goods receipt), and vendor invoice. However, POs and receipts are optional and depend on how the company runs its business.

- The purchase order, used to initiate a purchase, is sent from an organization’s purchasing department to a vendor. The PO will include a list of the requested merchandise, quantities of each item requested, and a final price for the order.

- Once the purchasing organization receives the merchandise, a receiving report is drawn up to document the shipment: This report will include any damages or quantity discrepancies associated with the order.

- Finally, the vendor sends the invoice to the purchasing organization to request payment for the goods or services provided. Accounts payable receives the vendor invoices and begins the invoice management process.

Often, accounting clerks manually match invoice line items against the PO and/or receipt line items by comparing the documents side-by-side as part of the invoice management process. This method is time and resource-intensive without an accounts payable automation platform.

The role of internal controls and audits in the account payable process

Eighty-two percent of organizations were subject to successful fraud in 2019 due to poor internal controls and audits. Sufficient operating procedures are extremely important to reduce improper payments, ensure regulatory compliance, and reduce the risk of human error.

Additionally, internal controls and audits are required to ensure safety and security within your organization. Internal controls help mitigate risk by creating a system of checks and balances within your AP department–systems that monitor the data entry controls, payment entry controls, and obligation to pay controls. These internal controls are in place to keep your payments safe and avoid human error within your organization.

How do you record accounts payable transactions?

When a company receives a bill or invoice, an accountant records it as an accounts payable transaction. The expense account for the goods or services purchased is credited, and accounts payable is debited.

What is an accounts payable system?

An accounts payable system tracks and manages the money a company owes to its vendors, traditionally through an automated system, that ensures accurate and timely payments.

Does accounts payable go on the income statement?

No, accounts payable does not go on the income statement. Accounts payable are liabilities on a business’s balance sheet, a debt a company owes to another party, not income or expense items. When a business pays its accounts payable, the liability on the balance sheet reduces, but it does not affect the income statement.

What is the relationship between cash flow and accounts payable?

For any purchasing organization, accounts payable is recorded as a short-term liability in the balance sheet. Over time, accounts payable can have a major impact on cash flow.

Accounts payable is considered to be a source of cash, meaning that if accounts payable is managed properly, organizations can take advantage of supplier agreements and increase cash flow and cash on hand. Business managers and accountants may reference their accounts payable and manipulate their cash flow accordingly to achieve specific outcomes.

For example, your company may be starting on a new project that requires your cash reserves to be as sound and healthy as possible. In order to allocate more funds to the project, management could abstain from paying outstanding AP for a period of time: While this is okay in the short term, it is important to keep in mind that this form of cash manipulation may result in long-term damaging effects to vendor relationships or business reputation. Taking steps to

Overview of AP software

Accounts payable (AP) software, often referred to as AP automation software, is a type of financial management solution designed to simplify, streamline, and automate the accounts payable process. It helps automate time-consuming manual processes such as invoice capture and invoice approvals and even helps identify errors within the payment process (i.e. duplicate invoices). AP automation software provides businesses with visibility into their existing processes, identifies ways to streamline current processes, and improves control of the end-to-end payment process.

Why automate accounts payable?

Every company receives invoices and makes payments to vendors. However, processing these invoices and paying bills manually requires a considerable amount of time and is particularly costly. On average, it costs $12-15 to manually process an invoice, plus an additional $5 to pay via paper check. Manual accounts payable can also strain visibility and operational resources and burden the accounting team.

Using accounts payable automation, organizations can restructure their AP departments to improve inefficiencies associated with manual processes and reduce hard and soft costs by up to 80%.

AP automation streamlines your accounts payable process from invoice capture to payment execution and keeps your information up-to-date and ready to use. With AP automation solutions like MineralTree, your accounts payable process becomes faster, easier, and more secure, saving your organization two valuable resources: money and time.

Frequently asked questions about accounts payable

AP basics & invoicing FAQ

What is accounts payable vs. accounts receivable?

Accounts receivable (AR) is the opposite of accounts payable. AR is the money a company expects to receive from customers, and AP is the money a company owes to its vendors. For example, when your business purchases goods from a vendor on credit, you will record the entry to accounts payable, and the vendor will record the transaction to accounts receivable.

What is the difference between trade payables and accounts payable?

Despite the two terms being used interchangeably, trade payables and accounts payable do not have the same meaning. Trade payables refer to the money owed by a company to its suppliers for goods or services that are directly linked to the company’s primary business activities or “trade.” This traditionally includes purchasing inventory, raw materials, or goods for resale. Accounts payable involves all payments a company owes suppliers for goods purchased or services received, regardless of whether they are directly related to the company’s core business activities.

What is the role of accounts payable?

The role of accounts payable is to process invoices, payments, and other financial transactions efficiently and timely. AP departments also play a key role in controlling company expenses by verifying invoices and ensuring payments are made on time.

What does AP stand for in business?

AP stands for accounts payable, or payables, referring to the short-term debts a business owes to its vendors or suppliers that have not been paid or settled. These obligations are recorded on the company’s balance sheet as current liabilities and are a part of the work for the accounts payable department.

What are bills payable?

Bills payable refers to the liabilities that a business owes to its suppliers for goods or services that have not yet been paid for. These are usually short-term payment obligations that need to be settled within a certain time frame, depending on the terms negotiated with the suppliers.

What is an accounts payable invoice?

An accounts payable invoice is a request for payment sent from a supplier to the accounts payable department. These invoices are generally outstanding amounts for particular goods or services purchased.

What is AP invoicing?

AP invoicing is the process of receiving and processing invoices from suppliers to pay for goods or services received.

What is the invoice management process?

Also known as invoice processing, invoice management is the process by which organizations track and pay vendor invoices. This process involves invoice capture, validation, payment, and recording the payment in the company’s ERP or accounting system.

The AP process FAQs

How do you process an invoice for accounts payable?

Processing an invoice for accounts payable involves a series of steps to ensure that invoices are processed accurately and efficiently. The steps include receiving, reviewing, and validating the invoice, then matching the invoice to the purchase order (PO), capturing and coding the invoice, invoice approval, and finally, paying the invoice.

What is the AP workflow process?

The accounts payable workflow is the complete end-to-end process of obtaining services and goods and processing and paying the invoices related to those transactions. This includes invoice capture, approval, authorization, execution, and supplier management.

Assets & liabilities FAQs

Is accounts payable a debit or credit entry?

Since accounts payable is a liability, it should have credit entry. This credit balance then indicates the money owed to a supplier. When a company pays its supplier, the company needs to debit accounts payable to decrease the credit balance.

Is accounts payable a liability or an expense?

Accounts payable is a liability since it is money owed to one or many creditors. Accounts payable is shown on a business’s balance sheet, while expenses are shown on an income statement.

Is accounts payable an asset?

No, accounts payable is not considered an asset since it is classified as a liability on a company’s balance sheet.

The AP balance sheet, the income statement & journal entries FAQs

Does accounts payable go on a balance sheet?

Yes, accounts payable does go on a balance sheet. It’s typically listed under current liabilities, as they are payment obligations that are expected to be settled within one year.

How is accounts payable listed on the balance sheet?

Accounts payable is listed on a business’s balance sheet, and since it is a liability, the money owed to creditors is listed under “current liabilities.” Typically, current liabilities are short-term liabilities and less than 90 days.

What is the journal entry for accounts payable?

A journal entry in accounts payable functions as a record of a debt your company incurs when purchasing goods or services on credit. For example, if your business makes a payment to a vendor for $5,000 for inventory purchased on credit, this transaction will need to be reflected within their AP records where $5,000 was debited from the accounts payable account. This debit entry reduces the amount owed to the vendor, reflecting the payment made to settle the outstanding liability.

Concurrently, $5,000 has been credited to the cash account, representing the decrease in the cash balance due to the payment made to the vendor. This journal entry accurately reflects the payment to the vendor, resulting in a decrease in the AP balance and cash assets.