“If you don’t measure it, you can’t improve it.” – Peter Drucker

Measuring the success of an accounts payable team requires more than tracking how many invoices are past due. It requires measuring key performance indicators (KPI’s) that will help your AP department reach their goals, maintain strategic vendor relationships, and improve cash flow management. Keep reading to see how your business can take advantage of these essential KPIs for accounts payable.

What are KPIs in Accounts Payable?

Key performance indicators (KPIs) in accounts payable are metrics that help a business and its AP department understand how they can track and reach their goals by optimizing existing AP workflows. Some common KPIs in accounts payable include:

- Days Payable Outstanding (DPO’s)

- Invoice processing costs

- Invoices processed per employee

- Percentage of spend per payment

- Average time to payment

- Percentage of payment errors

Why are KPIs in Accounts Payable Important?

While paying vendor invoices is the aim of the accounts payable team, there are a whole host of benefits businesses can gain by taking a strategic approach to the way they go about understanding and measuring their accounts payable KPIs.

AP KPIs enable AP departments to track and improve productivity, efficiency, and cash flow, while supporting positive supplier relationships. This makes them critical to successful AP. Failing to capitalize on the benefits of KPIs within accounts payable equates to missed opportunities for your business to improve short-term cash flow, build beneficial relationships with your vendors, and drive additional revenue.

6 KPIs for Accounts Payable to Measure Success

Determining if your AP process is as successful as it could requires monitoring key performance indicators (KPIs), each uniquely weighted to reflect what matters most for your business. Here are 6 accounts payable metrics that every AP team should measure:

1. Accounts Payable Cost Per Invoice

Understanding this metric is paramount to getting a grip on how much room for improvement your accounts payable process is leaving on the table. The formula to calculate it is a simple one: Total Accounts Payable Cost / Total Number of Invoices Processed.

Costs that go into this metric include:

- Labor costs: Covers personnel involved in accounts payable and the hours they work

- Accounts payable infrastructure costs: Covers accounts payable software/tools used to pay invoices

- Paper check & envelope costs

- Postage fees

Accounts Payable Cost per Invoice is estimated to run as high as $15.97 per invoice. With hundreds of invoices typically processed on a monthly basis, these costs can quickly become extravagant.

While most of the associated accounts payable costs may seem to be static, there is actually potential for a great deal of variation, and an opportunity to quickly cut this cost down. In fact, “top-performing” accounts payable teams report an average cost of $3.62 per invoice.

The prime culprit of excessive accounts payable costs? Look no further than the amount of manual intervention required across the end-to-end invoice handling process.

The more time your AP personnel spend on AP-related activities like handing off invoices to department heads for approval, entering invoice data into the accounting system, and postmarking paper checks, the higher your Accounts Payable Cost Per Invoice will rise. Additionally, manual intervention also creates additional opportunities for errors in the process, which can increase in cost tenfold when they are discovered downstream in the process.

2. Average Time to Payment

Average Time to Payment is the metric that is most indicative of Accounts Payable Cost Per Invoice. The formula to calculate this metric is also simple:

Total Time Spent Processing Invoices / Total Number of Invoices Processed

The clock on Total Time Spent Processing Invoices for each invoice starts running as soon as the invoice is received, and continues running until your vendor receives the payment. Average Time to Payment is also a very variable metric and can run as high as 12.2 days or as low as 3.7 days.

How is this metric linked to Accounts Payable Cost per Invoice? As the amount of time an invoice remains unpaid increases, so do the costs associated with getting that invoice paid – particularly labor costs. Think of it this way: The faster your AP staff can get invoices off their plates, the less bogged down they will be when new invoices arrive. In the same vein, the more invoices your AP staff is handling, the less capacity they will have to focus on new invoices, and your Average Time to Payment can gradually climb (along with Average Accounts Payable Cost per Invoice).

There is also an opportunity cost associated with this metric: Early-Pay Discounts. Extravagant amounts of time required to process invoices can prevent businesses from capitalizing on Early-Pay Discounts that would otherwise provide a nice boost to the bottom line.

However, the targeted Average Time to Payment may vary from company to company, as some businesses like to hold onto cash longer than others. For this reason, the lowest Average Time to Payment is not always the best. Rather, what’s most important is understanding what Average Time to Payment gives you the command over cash flow that you are looking for.

3. Percent of Spend By Payment Method

This metric is the distribution of all of your vendor payments by payment method. It can be calculated by dividing the total number of payments made with each payment method by the total number of vendor payments made.

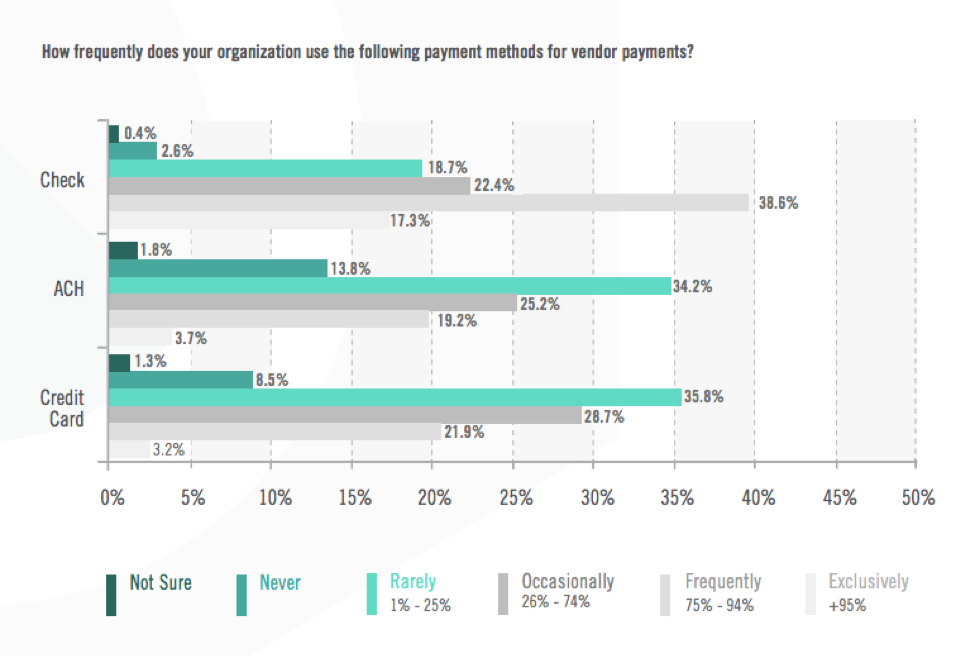

In spite of the well-documented fraud risk that accompanies paying vendors with paper checks, over 17% of businesses are using paper checks exclusively for B2B payments. Another 38% of businesses use paper checks for 75% or more of their payments.

Businesses should strive to shift as much spend as possible over to electronic methods like ACH transfer and credit cards that are both simpler and more secure. Additionally, credit card payments can earn you cash-back rebates – another helpful boost to your bottom line.

4. Percentage of Electronic Payments

Compared to checks, electronic payments are cheap, easy to process, and a great way to cut down on costs. AP teams can take advantage of this by tracking how many electronic payments they are making each month, and the percentage of electronic payments of total payments made. From there, AP teams can calculate the amount of spend saved from using electronic payments and the potential earnings if all payments were processed electronically.

5. Time Spent Responding to Inquiries

According to the State of AP report, 43% of AP teams spend over 6 hours weekly answering vendor questions, and about 23 minutes regaining their attention on a task following an interruption. Accuracy also falls short. According to the Journal of Experimental Psychology, employees are prone to make double the number of errors when they are interrupted, even if it’s only for 3 seconds. So not only does the time spent responding to supplier inquiries put a halt on AP productivity, but the potential errors and time spent to regroup after an inquiry also play a part.

Businesses should analyze why vendors are contacting their AP team and discover ways to streamline this communication to prevent continuous disruptions. By reducing the time spent answering vendor inquiries, organizations can give time back to AP departments to focus on more strategic initiatives.

6. Number of Late Payments

Late payments to suppliers not only weaken supplier relationships, but can result in additional costs from late payment fees or interest payments. It is essential that AP teams track the percentage of late payments each month and look for new ways to improve their existing payment process to stay ahead of supplier payments.

Lowering the amount of late payments will not only help improve cash flow and promote positive supplier relationships, but you may also be able to take advantage of early pay discounts in exchange for paying a supplier’s invoice before the due date — which sounds like a win-win to us!

Driving Improvement Across These Accounts Payable KPIs

Owning these KPIs means increased efficiency, decreased fraud risk, and more value-added projects for your team.

When it comes to driving improvement across these accounts payable KPIs, businesses in all industries have been looking to AP analytics and AP automation solutions that help manage and monitor these essential KPIs. Cloud-based automated accounts payable solutions integrate with your bank account and accounting system to streamline the reporting and analysis of AP metrics. Businesses with a strong handle on their AP KPIs are able to improve cash flow, mitigate fraud, and strengthen supplier relationships.

Many mid-market businesses have seen accounts payable productivity increase by 60% by leveraging accounts payable automation, and have also been repaid for their up-front investment within 60 days of implementation.

To learn more about how automated accounts payable can help you gain deep insight into your KPIs, contact MineralTree for a personalized demo.

Accounts Payable KPIs FAQs

What Are KPIs?

Key performance indicators (KPIs) are metrics used by businesses to understand how they can track and reach their goals by optimizing existing processes. Examples of KPIs in accounts payable include:

- Accounts Payable Cost Per Invoice

- Average Time to Payment

- Percent of Spend By Payment Method

- Percentage of Electronic Payments

- Number of Late Payments

- Time Spent Responding to Inquiries

How Do I Choose the Right KPIs for My Business?

To understand what accounts payable KPIs your business should track, you must first identify key AP goals and objectives, consider industry benchmarks, prioritize SMART KPIs, and analyze trends, data, and performance within your AP analytics. By defining clear KPIs for your AP team to track, your business can make informed decisions, optimize operations, and contribute directly to your business’s financial success.

How Often Should I Track my KPIs?

Depending on the type of KPIs your business monitors will determine the frequency of how often you should track them. It’s important to track your KPIs regularly so that you can identify trends and make adjustments to your business strategy as needed.

How Can I Improve my KPIs?

A few ways businesses can work to improve their KPIs include:

- Setting SMART goals

- Determining what KPIs are important to track

- Encouraging data-driven decision-making

- Providing visibility across departments

- Reviewing and revising KPIs regularly