Efficient digital payments are critical for accounts payable (AP) teams to streamline the AP process and maintain strong relationships with vendors. However, managing payments through QuickBooks alone involves resource-intensive manual processes and limits teams’ ability to handle diverse invoice types.

These hurdles stifle efficiency and accuracy, hindering the overall productivity and success of AP teams. But with the right AP automation solution, you can automate and simplify the entire AP process. Modern solutions address the inherent challenges of QuickBooks payments while offering greater control, efficiency, and security in your financial management.

Key takeaways

- AP teams that rely solely on QuickBooks for payments experience vendor enrollment issues, sync challenges, and tedious, manual work.

- AP automation mitigates the challenges of timely payments and manual process complexities associated with QuickBooks by streamlining and automating the AP process.

- Integrating MineralTree with QuickBooks enables teams to make seamless and secure digital payments with unlimited seats, allowing users to scale their businesses.

How do QuickBooks payments work without AP automation?

QuickBooks is a full-featured accounting system with accounts receivable and accounts payable functionality. In terms of payment types, QuickBooks offers basic ACH and credit card support for B2B payments through QuickBooks Online Bill Pay. Through an upcharge, QuickBooks also has an offering that allows companies to pay vendors in a variety of formats and pre-schedule payments.

The company also allows companies to connect with their vendors via the QuickBooks Business Network, which makes it easy to make pay bills from other QuickBooks customers. . While the network facilitates sending invoices and payments between QuickBooks users, it doesn’t allow you to pay various non-purchase order invoices like utilities, rent, and supplier costs. And, if your vendor isn’t using QuickBooks, additional steps are required to pay suppliers. Traditional AP automation solutions offer capabilities to tackle these challenges.

Making payments in QuickBooks without QuickBooks Bill Pay or AP automation requires manual processes that are often inefficient and tedious. The payment processes for QuickBooks Desktop and Online differ slightly, but both involve manual data entry, accuracy checks, and separate bank feeds and credit card statements for reconciliation.

Challenges in managing payments in QuickBooks

Beyond manual processes, managing payments solely using QuickBooks introduces several challenges:

1. Vendor enrollment

2. Manual processes

3. Sync issues

1. Vendor enrollment

A buyer and vendor must be QuickBooks users to facilitate digital payments, but many larger and more established vendors don’t use QuickBooks. Enrolling vendors into the platform is a resource-intensive process, which often relegates businesses to traditional payment methods like checks and ACH.

2. Manual processes

Managing payments in QuickBooks without AP automation involves time-consuming and error-prone processes. This includes manual invoice receipt and verification, payment reconciliation, and even reporting and auditing, all of which eat away at valuable resources. In fact, about 1 out of 4 financial professionals surveyed noted that manual data entry is a challenge when it comes to QuickBooks.

3. Sync issues

The wrong AP automation solution can also pose problems for teams. Since QuickBooks is your company’s system of record, it’s important to invest in a system that offers a true bi-directional sync. Many tools will advertise their syncing capabilities and showcase a seamless integration from their solution to QuickBooks.

However, these solutions may not be able to sync as effectively back from QuickBooks to the AP automation technology. Changes made in QuickBooks or your AP software solution should be reflected in both locations. Delayed or inefficient syncing not only complicates financial management but also prolongs the payment process and leads to late payments.

Did you know? Continuous syncing is even possible for QuickBooks Desktop users with the right AP automation platform. MineralTree offers offline syncing via a connector that is located on the same server as your QuickBooks solution so that the two systems are continuously exchanging data, even when offline.

4. International payments

Making international payments in QuickBooks is challenging, since these are not currently offered in the platform. Instead companies must leverage third-party tools to pay international vendors.

How AP automation improves payments made through QuickBooks

The pain points discussed above highlight the importance of investing in the right AP automation solution to get the most from your QuickBooks solution. AP automation platforms like MineralTree address critical issues that QuickBooks alone can’t handle, providing a more comprehensive, efficient, and secure payment process. We outlined 7 ways AP automation improves payments made through QuickBooks below.

1. Ensure payments are timely

2. Improve the invoice approval process

3. Enroll vendors in online payments

4. Extend the life of your ERP

5. Enhance data capture

6. Access unlimited seats

7. Separate duties for better fraud detection

1. Ensure timely payments

Payments made through QuickBooks can be complicated, especially if vendors don’t have QuickBooks. Without AP automation, this process can be very manual, especially if AP teams support various payment methods.

However, many AP automation providers dictate payment timings and methods, relying on pre-funded settlement accounts that delay funds transfers to vendors. The right solution hands you the reins and allows you to control the timing of payments so you can pay vendors on time.

Did you know? MineralTree uses direct debit to ensure your payments are processed and received by vendors promptly, which helps you maintain vendor relationships and financial reliability.

2. Improve the invoice approval process

QuickBooks Desktop lacks a built-in invoice approval workflow, necessitating the integration of additional services for this functionality. AP automation solutions streamline and automate this process, which enables faster decision-making and reduces the administrative burden on your staff. This enhancement does more than just speed up the payment cycle—it also adds a layer of control and oversight to the expenditure process.

3. Enroll vendors in online payments

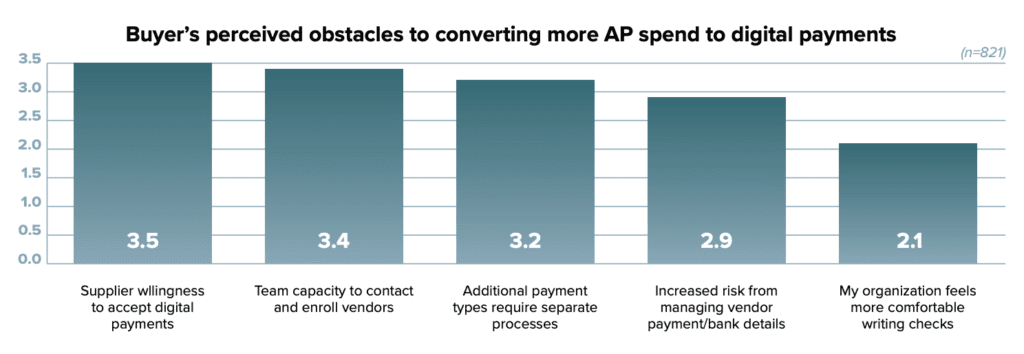

Data from MineralTree’s recent State of AP Report revealed that vendor enrollment is one of the most significant challenges in buyers’ transition from checks to digital payments. Despite the growing preference for digital payments, most teams are too stretched thin to contact, enroll, and maintain vendors. This makes it critical to identify AP automation providers that offer managed services.

Did you know? MineralTree delivers a collaborative and robust vendor enrollment process for SilverPay that helps handle the enrollment of preselected vendors to virtual card payments.

4. Extend the life of your ERP

Upgrading ERP systems can be prohibitively expensive for many businesses. AP automation helps extend the functionality and lifespan of your existing system by integrating advanced record-keeping, document management, and complex workflow capabilities. Enhancing QuickBooks with AP automation allows you to avoid or delay costly ERP upgrades while benefiting from improved efficiency and functionality. As a result, you can process invoices faster and focus on strategic initiatives instead of tedious tasks like data entry.

However, as noted above, it’s important to consider an AP automation platform’s ability to sync data bi-directionally. Not all systems are created equal, and while many tools can sync to QuickBooks, many struggle to extract data back to their AP technology. This problem isn’t unique to QuickBooks and can be found across ERP tools. Simple Mills, a company specializing in health-conscious snacks, faced challenges with its payment process using a legacy AP automation system. Issues related to syncing capabilities resulted in more exceptions to review manually, reducing the benefits of automation and ultimately reducing their return on investment.

When selecting an ERP provider, it’s important to consider whether the tool can grow with your company. As companies migrate from QuickBooks to more complex platforms, having a tool that can support various ERPs and provide migration support becomes increasingly important.

5. Enhance data capture

Accurate data capture is critical for effective and compliant financial management. However, QuickBooks alone does not offer invoice data capture capabilities. Most AP automation solutions rely solely on optical character recognition (OCR) technology for invoice processing, which typically results in a 60-70% accuracy rate—leaving plenty of room for error. That’s why you must carefully vet vendors and identify one that supplements OCR with human review to ensure accurate invoice processing.

Did you know? MineralTree offers a unique combination of human review and OCR technology to achieve a 99.5% accuracy rate in invoice processing. The solution can also capture both header and line item data for more advanced processing, AP analytics, and reporting.

6. Access unlimited seats

Both QuickBooks Desktop and QuickBooks Online charge an additional cost per user. So, as your business scales, the cost of adding users to the system can quickly become a financial burden.

Did you know? MineralTree’s pricing model does not charge per user, making it an ideal solution for growing companies. This approach contrasts with many competitors and QuickBooks itself, enabling easier collaboration for your team.

7. Separate duties for better fraud protection

Without automated approval workflows in QuickBooks, a single person controls invoice creation and payment authorization—significantly increasing your risk of fraudulent activity. AP automation introduces a robust framework for separating duties within the payment process. By dividing responsibilities between the accounting manager (who creates and manages invoices) and the payment authorizer (who releases payments), you can better safeguard against unauthorized transactions.

Did you know? MineralTree can send positive pay files to your bank on your behalf. This statement allows banks to monitor and verify checks, reducing fraud risk. If something deviates from the positive pay file, banks can alert companies that fraud has been attempted.

Final thoughts

MineralTree is the go-to AP automation solution that bridges the gap between critical financial processes and seamless digital payments. By integrating seamlessly with QuickBooks, MineralTree simplifies and automates the entire AP process while making digital payments a seamless experience.

With features like direct debit funding, two-way sync with QuickBooks, virtual card payments with rebates, and a dedicated implementation team, your team can achieve efficiency, accuracy, and timeliness in your payments. As a result, you can scale your business—and streamline your processes.

Get in touch with MineralTree to discover how AP automation enables more efficient and secure QuickBooks payments.

FAQs

1. Does QuickBooks have a payment processing system?

Yes, QuickBooks allows Online Bill Pay for Accounts Payable and separately sells the newer QuickBooks Bill Pay for QuickBooks Online. For B2B payments, the SMB QuickBooks Business Network facilitates transactions between QuickBooks users, but with limitations. Using an AP automation solution with QuickBooks can enable more efficient and secure transactions.

2. What are the pros and cons of using QuickBooks?

QuickBooks simplifies accounts receivable processes and offers basic AP payment capabilities. However, challenges like vendor enrollment, manual processes, and sync issues necessitate third-party AP automation for comprehensive financial management.

3. What is the best payment system for QuickBooks?

For businesses looking to enhance their QuickBooks experience, AP automation solutions like MineralTree offer the best payment system. MineralTree addresses the platform’s inherent limitations and provides a more efficient, secure, and scalable AP process.