Accounts payable (AP) automation is essential for finance professionals these days. With the promise of time savings, cost savings, and increased accuracy, it’s no wonder that businesses are eager to learn more about the benefits of automation. But how can you prove the ROI of AP automation to your stakeholders? Keep reading to understand the value of AP automation and how to measure its impact on your business.

Key takeaways

AP automation can help businesses save money by minimizing errors, improving cash flow, reducing labor costs, reducing risk, and more.

AP automation can provide a significant return on investment since it reduces labor costs by lowering expenditures and digitizing the entire process.

Measuring the ROI of AP automation requires looking at the number of annual invoices, the number of annual payments, the percentage of payments currently made electronically, and the annual accounts payable spend.

What is the ROI of AP automation?

The ROI of AP automation can vary depending on the size and complexity of your business and the specific features and capabilities of the AP automation solution you choose. However, AP automation can generally provide a significant return on investment since the process reduces labor costs by digitizing the entire process and lowers expenditures.

How AP automation saves companies money

AP automation can help companies save money in a variety of ways by reducing labor costs, minimizing errors, improving cash flow, and more. Here are a few of the ways AP automation can help your business save money.

Decreased labor costs

Manual AP processes are labor-intensive and require employees to manually enter data, match invoices to purchase orders, and approve payments. With AP automation, these tasks are automated, allowing employees to focus on more strategic tasks.

Reduced errors

Traditional accounts payable processes are prone to errors from incorrect data entry, duplicate payments, or missed payments. Errors can increase business costs, disrupt cash flow, and hurt vendor relationships. AP automation can help to reduce these errors by automatically validating data and ensuring that invoices are processed correctly by capturing and coding header and line-level data with up to 99.5% accuracy.

Improved cash flow & visibility

AP automation speeds up the payment process, improves cash flow, and helps businesses take advantage of early payment discounts and avoid late payments. It also gives businesses greater visibility into their spending, which can help them identify areas where they can save money, such as negotiating better terms with vendors.

Reduced fraud

Many AP automation solutions are equipped with fraud detection systems that can help to identify and prevent fraudulent activities, such as unauthorized payments. Reducing the risk of fraud not only helps businesses avoid financial losses but also prevents reputational damage.

More invoices can be processed with same number of employees

By using an AP automation solution, businesses can process more invoices without increasing headcount. In fact, according to our most recent State of AP Report, 64% of companies that implemented AP automation are processing more invoices with the same size team, and 13% have been able to reallocate staff time to other projects.

Better vendor relationships

Late or incorrect payments can significantly damage the relationship with your supplier. AP automation helps ensure vendors are paid on time and reduces payment disputes. In addition, when payments are made on time or early, some vendors may even offer early payment discounts or favorable terms from suppliers, which contributes to overall cost savings.

Fewer duplicate payments

AP automation can help detect duplicate invoices and identify and prevent invoices from being paid twice. Companies avoid unnecessary expenses and maintain a healthy cash flow by eliminating duplicate payments.

Enroll more vendors in digital payment methods

Digital payments are faster, more secure, and often come with cashback incentives or rebates, resulting in additional cost savings for companies. But enrolling vendors in a digital payment method can be difficult. MineralTree’s AP automation solution includes comprehensive managed payment services, including continuous virtual card and ACH enrollment, to help move vendors off checks so you both can unlock the benefits of digital payments.

How to measure the ROI of AP automation

Measuring the ROI of AP automation requires looking at the number of annual invoices, number of annual payments, percentage of payments currently made electronically, as well as the annual accounts payable spend. Check out the ROI calculator to get a better idea of the ROI your business could have from switching to AP automation.

How NEW Health Programs established a continuously-growing ROI

NEW Health is a non-profit organization focused on getting the most out of its resources in order to maximize the value it can pass on to its surrounding community. After noticing that their manual AP processes were prone to costly mistakes, they switched to MineralTree AP automation solution to help streamline operations. As a result, they saw a variety of benefits, specifically in their ROI.

“Having MineralTree has allowed me to re-allocate one of my AP employees to a new department,” explained CFO Adam Jones. “This has resulted in cost savings of about $35-$42k. It has also enabled us to enhance our reporting mechanisms and our budgeting process to make it more detailed and robust than it ever has been before.”

Final thoughts

Streamlining the AP process is essential for growing businesses looking to maximize operational efficiency. With an AP automation solution, companies can reduce invoice processing times, minimize errors, and improve cash flow management–all aspects that immediately benefit operational efficiency and increase ROI. Ready to see how switching to an AP automation solution can help influence and increase your business’s ROI? Use our ROI calculator or request a demo today to learn more.

AP automation ROI FAQs

What is the impact of AP automation?

AP automation can significantly impact business operations by reducing the cost per invoice, improving cash flow by taking advantage of early pay discounts and reducing late fees, and organizing the end-to-end accounts payable process. As a result, businesses of all sizes improve accuracy, efficiency, cash flow, compliance, and visibility.

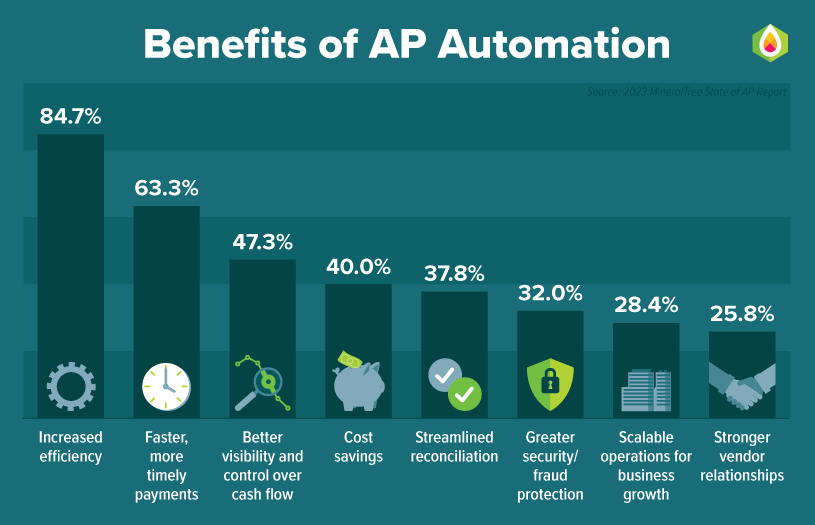

What are the benefits of accounts payable automation?

Accounts payable automation provides a variety of benefits, including streamlined AP processes, increased efficiency, reduced costs, and improved compliance, and helps strengthen valuable supplier relationships.

What is the direct and indirect ROI of AP automation?

Direct ROI refers to the benefits that can be quantified or approximated utilizing a cost model. For example, a direct ROI of AP automation reduces the time spent on manual processes, frees up valuable time, and reduces processing times. Indirect ROI of AP automation refers to the benefits that stem from a more strategic approach. For example, vendors may offer early-pay discounts as your payment cycle improves with an AP automation solution.