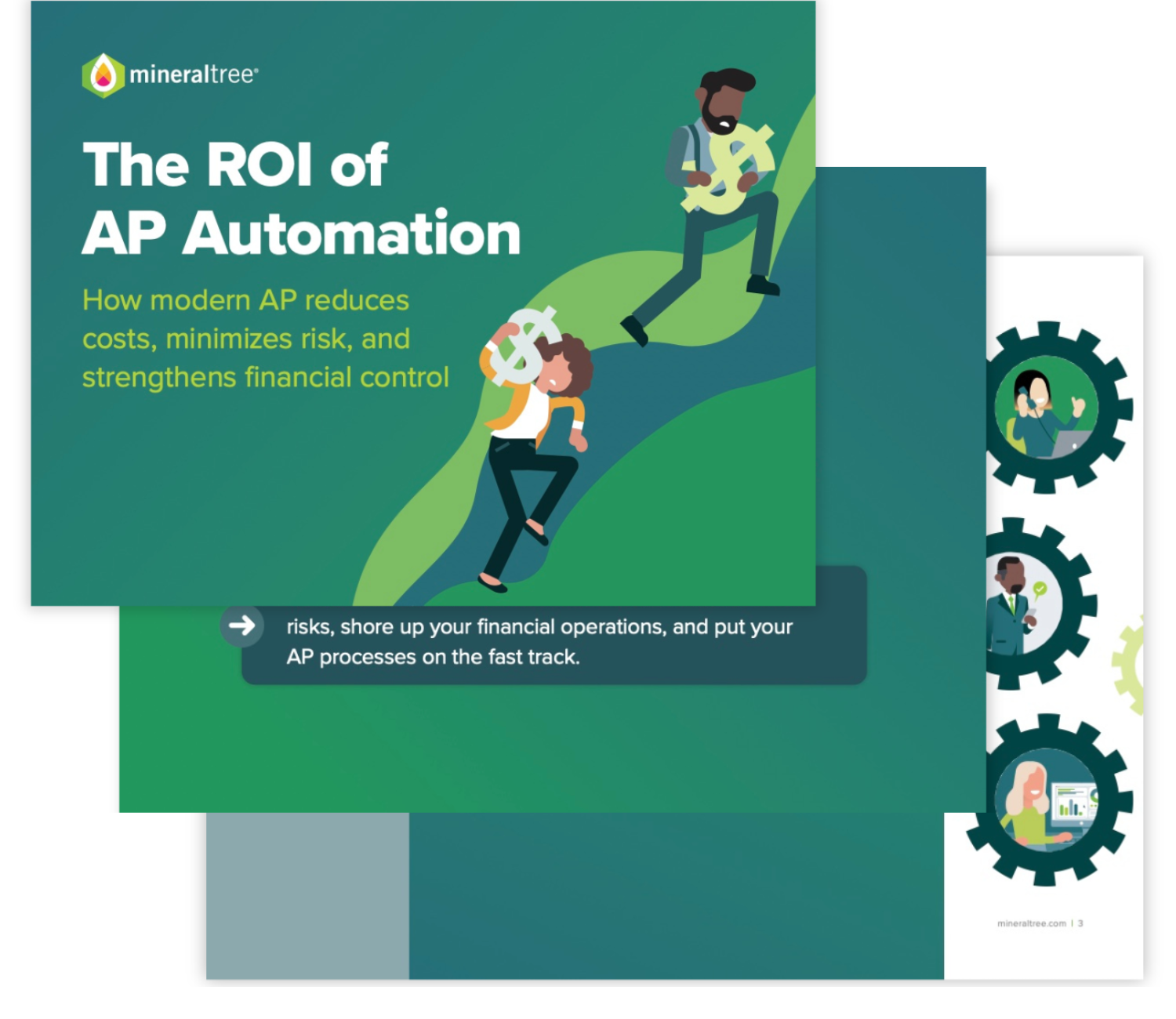

How modern AP reduces costs, minimizes risk, and strengthens financial control

Accounts payable (AP) is one of the most overlooked areas for digital transformation. And a costly one. Manual AP processes can quietly bleed cash and expose your business to risk in the form of unnecessary expenses, high payment error and fraud rates, poor visibility into cash flow, weak audit trails and an inability to scale your business.

But when you tightly integrate AP automation into the finance software you use every day, it becomes a seamless part of your workflow, transforming AP from a cost center into a streamlined, strategic function.

Download the eBook now to learn how AP automation can:

- Reduce invoice and payment processing times and costs

- Improve cash flow

- Enhance your supplier relationships

- Help reallocate your team’s time from low-value processing to high-value analysis by connecting AP and purchasing in one intelligent workflow

The ROI Behind AP Automation

52%

saw gains in daily operating efficiency.

40%

absorbed a growing volume of invoices with the same-sized team.

28%

reallocated freed-up staff time to other crucial projects.

46%

reported faster, more timely

vendor payments.

Reduces costs, minimize risk, and strengthen financial control through modern AP

Discover Real-World Success Stories

Dive Deeper With These Resources

Schedule a Demo

Interested in learning more? Get in touch with our sales team to learn more about how MineralTree