Conducting a cash flow analysis is an integral part of running a business — dedicating time to this process can mean the difference between barely surviving and thriving. However a cash flow analysis is only as valuable as your ability to understand and interpret the results. By assessing your cash inflows and outflows, you can gain valuable insights into your organization’s financial health, helping you make informed decisions to sustain and scale your operations. Let’s review how to get this important process right.

What is a Cash Flow Analysis?

A cash flow analysis is the process of tracking, analyzing, and managing money movement in and out of a business. It involves examining all sources of revenue and expenses to understand the liquidity and financial stability of a company. Essentially, it can help businesses determine if bills can be paid, operating expenses will be covered, and if there is a buffer for unexpected costs.

Components of a Cash Flow Statement

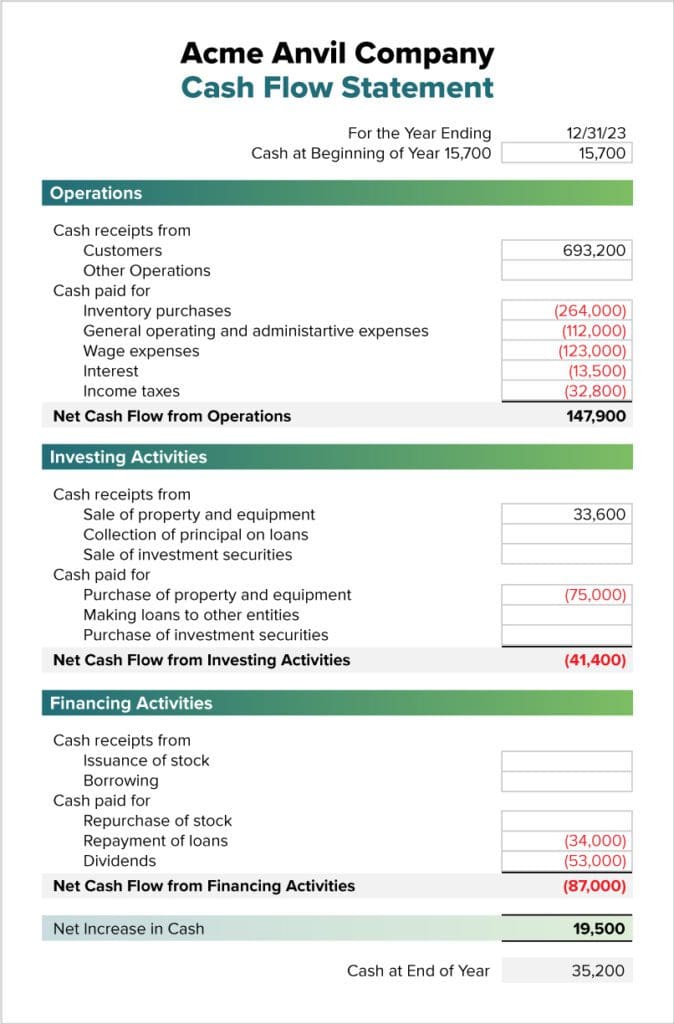

Before diving into a cash flow analysis, there are three critical components to understand about how money flows in and out of your organization.

Cash Flow from Investing Activities

Investment cash flow represents all cash made or spent on things like equipment, company vehicles, real estate, or stocks. Tracking investment spending is just as important as operating cash flow, as it can have a large impact on your overall financial position.

Cash Flow from Operations

Operating cash flow is the cash generated or used by a company’s core business activities — sales, expenses, payroll, and rent are all included, as are changes to working capital. This is where profitability is determined — positive operating cash flow indicates a healthy primary business operation.

Cash Flow from Financing

Financing cash flow accounts for cash raised or spent on financial activities like loans, share repurchases, dividends, and similar financial products. Assessing financing cash flow allows you to get a picture of how external financing affects your cash position and debt levels.

Why Does Cash Flow Analysis Matter?

Maintaining a clear view of the money flowing in and out of your company is important for several reasons. First, it’s the primary method of determining financial health. Without a clear picture of where your businesses cash is going, you risk insolvency and taking on unmanageable levels of debt in short order.

However, most businesses already have at least some understanding of their overall cash flow at a given moment. Analyzing your cash flow provides a complete view of your company’s finances, giving you the data needed for proper budgeting and planning, stronger financial decision-making, and insight into customer spending trends. This is also a great proactive exercise for any business with external investors — having a detailed understanding of cash flow makes annual reporting and investor updates significantly easier.

How to Conduct a Cash Flow Analysis

To begin the processes of assessing your company’s cash flow, follow these steps:

Prepare a Cash Flow Statement

The first step to assessing cash flow is laying out the facts of the money going in and coming out of your organization. A proper cash flow statement has a defined accounting period and categorizes inflow and outflow of cash into operating, investing, and financing categories. You’ll likely prepare more than one cash flow statement during your analysis, especially if you plan on examining performance and company health over time.

Investigate the Data

While many philosophies govern how cash flow statements are formatted and how they present financial data, they should all provide a solid picture of a company’s overall performance and financial health.

However, an important decision you will need to make is whether to use a direct cash flow analysis or an indirect cash flow analysis. The main difference between the direct and indirect methods is how they report operating cash flows. The direct method presents the cash receipts and payments directly, offering more transparency but requiring more detailed data. The indirect method, alternatively, starts with net income and adjusts for non-cash items and working capital changes, making it simpler to implement but ultimately providing less detail.

Consider Digital Processes

Digital transformation in finance is gaining popularity since it streamlines back-end processes. As a result, your team can more easily access data while mitigating the risk of human error. While this step isn’t necessary to conduct a cash flow analysis, investing in automation tools can help make the process easier in the future.

Challenges of Cash Flow Data

Conducting a thorough cash flow analysis can be difficult, depending on how your business operates.

Accurate Data and Manual Processes

From the outset, many companies struggle because they do not have accurate data, or the data they do have is inaccessible or needs to be manually pulled. Bad, incomplete, or inaccessible data can make a cash flow analysis time-consuming and prone to error.

Complexity in the Business

Similarly, cash flow analysis exercises can falter because of the sheer magnitude of a business’ operation — the more revenue streams, investments, and financial supports, the more time-consuming and complex the activity becomes. And as a result of these challenges, forecasting becomes moot since inaccurate or unreliable historical data is in the mix.

Caution Over Historical Data

When conducting a cash flow analysis, it’s important not to take historical financial data at face value. Over-reliance on dated financial information can imperil forecasting and threaten the accuracy of more recent accounting. For example, is depreciation consistently accounted for in all data? Are you accounting for inflation or changes in the market?

The bottom line: The way financial data was tracked a decade ago may not be the same as today — and these inconsistencies can throw off well-intentioned historical financial analysis.

How Can AP Automation Help With Cash Flow Analysis and Management?

Accounts payable technology provides a centralized view of pending invoices and bills. This helps you anticipate upcoming payments, allocate funds efficiently, and ensure you always have enough cash to cover your obligations.

AP software solutions help reduce manual errors and keep financial data organized and consistent. Given the need for accuracy, many companies are turning to AP automation platforms: Adoption has grown by 61% between 2021 and 2022, according to MineralTree’s 2023 State of AP Report.

AP automation delivers:

Better Insight into Upcoming Payments

A centralized view of pending invoices and bills gives you an immediate window into upcoming payments, helping you allocate funds correctly and ensuring you can always cover your obligations. These insights can also help your team reduce their reliance on historical data since upcoming payments can better speak to a company’s obligations in the future.

Sophisticated Reporting Capabilities

Automation systems generate detailed reports, simplifying the tracking and analysis of cash flow. These reports offer real-time visibility into your financial data, making it easier to identify trends and areas for improvement. AP reports from MineralTree do not need to wait for an invoice to be posted to the ERP. Instead, these reports can use data upon invoice capture, allowing for a more comprehensive view of upcoming payments.

Fewer Unnecessary Expenses

AP automation helps reduce the risk of duplicate payments and fraudulent activities. By automating the invoice approval process, you can catch discrepancies before they affect your cash flow.

More Efficiencies

AP automation is key to digitizing cash flow analysis – both help take the full picture of your finances and bring them into a much sharper, more understandable focus. Automating tasks frees your finance team to focus on strategic cash flow analysis and planning. It also reduces the risk of human error, ensuring more accurate financial data.

Final Thoughts

Conducting a cash flow analysis is a fundamental part of managing your business’s finances. It provides the insights you need to make informed financial decisions, plan for the future, and ensure stability. AP automation tools can simplify data gathering and reporting in this process, making cash flow analysis more accessible and effective. By mastering this essential financial skill, you can secure your business’s financial health and drive it towards sustainable growth.

However not all AP tools are created equal. MineralTree’s cloud-based, end-to-end AP automation solution integrates seamlessly with your existing systems like Quickbooks, NetSuite, Sage Intacct, and other ERPs, providing a suite of features from invoice capture to payment authorization. It can also reduce total cost per invoice by up to 80%, giving your AP teams the power tool to do more work faster.

If your cash flow analysis gets stalled because of bad data or a lack of resources, MineralTree can help. To learn about the benefits of AP automation and experience how it can transform your understanding of cash flow, reach out to us for a free demo.