The check lives on, but businesses (and their vendors) are changing the B2B payment trend mix

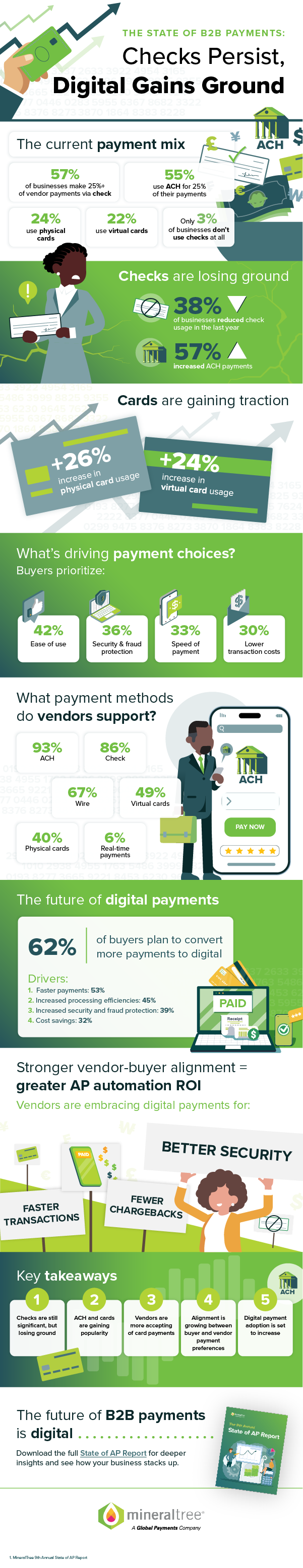

Like it or not, checks remain a significant part of the B2B payment trend mix. In the last 12 months, over half (57%) of businesses made more than one-quarter of their vendor payments via check. That compares with 55% of businesses making more than one-quarter of their payments using ACH, 24% physical cards, and 22% virtual cards. In fact, only 3% of businesses don’t use checks at all.

That’s according to MineralTree’s most recent Annual State of AP Report which included an independent survey of over 1,100 finance professionals (both buyers and vendors) in the U.S.

Despite their extraordinary staying power, checks continue to lose ground in the world of AP. When asked how their payment mix had changed over the last 12 months, respondents indicated that checks were the biggest loser and ACH the biggest winner as a percentage of vendor payments. Thirty-eight percent of respondents reduced their use of checks (vs. 11% for physical cards, the next highest decrease) while 57% increased their use of ACH.

Cards, both physical (+26%) and virtual (+24%), are gaining ground as vendors get more comfortable trading faster, more secure payments for the higher processing fees involved with card payments.

Despite the recent hype, real-time payments (RTP) have yet to gain any solid traction for mid-market businesses. Forty-five percent of buyer respondents in our survey don’t use them at all, and only 6% of vendors currently accept them.

Speed, security, and cost drive payment choices

When buyers were asked about what drives their payment method decisions, they cited multiple factors including ease of use (42%), security and fraud protection (36%), speed of payment (33%), and cost of the payment method (30%).

Vendor acceptance is also a factor of course. When we asked vendors what payment methods they accept, they were well-aligned with buyers. ACH (93%), check (86%) and wire (67%) topped the list trailed by virtual (49%) and physical (40%) cards. Real-time payments barely made the list at 6%.

It was interesting to see the strength of cards here. In the latest report, card acceptance jumped from previous years with 49% of vendors accepting virtual cards and 40% accepting physical cards. In the past, vendors have cited higher processing fees as a major obstacle, but resistance may be waning for a few reasons:

- Speed of payment, vendors’ biggest priority, may be outweighing the higher processing fees.

- The enhanced security and reduced chargebacks that come with virtual cards are appealing.

- Managed vendor enrollment programs by software vendors are accelerating vendor onboarding and virtual card acceptance.

Buyers want to make more digital payments, and vendors want to receive them

The majority (62%) of buyers plan to convert more payments to digital over the next year, driven by several factors: faster payments (53%), increased processing efficiencies (45%), increased security and fraud protection (39%) and cost savings (32%).

When buyers were asked about what their vendors feel is important in terms of their payment experience with their organization, speed of payment, correct payment amount, and responsiveness to payment inquiries topped the list. When vendors were asked the same question, i.e., what was most important to them, they cited many of the same factors: speed of payment, correct payment amount, responsiveness to inquiries, and processing costs.

Payments are one of the most common targets for automation in the AP process because they can deliver significant value for both buyers and their vendors. But adoption and ROI are dependent on alignment between the two parties’ self-interest. It appears we are making real progress in that regard, opening the door to even stronger adoption of AP automation and the increased value and benefits that come with that.

What’s driving the B2B payment shift to digital?

The infographic below goes into more detail on B2B payment trends and what’s behind the shift:

Download the full State of AP Report, which delves into this and much more.