According to the IRS, there are 1.9 million non-profit organizations operating in the US, including 1.8 million 501(c)(3) tax-exempt organizations.

If you’re part of a non-profit organization (NPO), you know that every penny counts. Still, many non-profits rely on manual or outdated accounts payable (AP) processes that waste valuable time and resources.

The non-profit accounts payable process requires adherence to specific operational requirements and rigorous reporting guidelines. Non-profits often struggle with high staff turnover and limited budgets. Because of limited funds, NPOs often have a hard time keeping staff and managing their finances.

To solve this problem, they need to embrace digital transformation. This will help them operate more efficiently and accurately in their financial activities.

With a robust system that automates and streamlines the AP process, non-profits can maintain financial accountability and ensure every dollar supports their mission.

Key takeaways

- AP automation significantly reduces manual tasks, allowing non-profit organizations to process more invoices with fewer resources.

- By reducing administrative overhead, AP automation allows non-profits to reallocate financial and human resources from routine transaction management to core mission-focused activities.

- Automation strengthens internal controls and reduces an organization’s susceptibility to fraud, which is particularly important for non-profits with high staff turnover.

An overview of accounts payable for non-profits

Non-profit accounts payable processes differ significantly from those of for-profit businesses, requiring stringent financial accountability and adherence to donor restrictions.

Unlike for-profit organizations, non-profits manage complex funding sources like grants and donations, each with specific stipulations. Non-profits must record and manage all incoming invoices related to these funds, verify details, and ensure proper invoice approval before payments are made.

Compliance with regulatory standards is also crucial, making the accounts payable function uniquely challenging and vital in non-profits. To maintain compliance, non-profits have to generate reports on a regular basis that demonstrate transparency and accountability to donors and regulatory bodies.

Top challenges finance teams face at non-profits

Finance teams at non-profit organizations face a number of challenges and inefficiencies—especially if they haven’t adopted AP automation.

1. Complex expense management

Finance teams at non-profits must meticulously manage expenses to ensure compliance with donor restrictions and maximize their impact per dollar spent. Accurate expense management requires a clear and transparent AP workflow that can handle multiple funding sources and expense categories—a complex and error-prone task without the proper tools.

2. Time-consuming processes

The AP process can be extremely time-consuming for non-profits that rely on manual processes or outdated technology. Manual processes often involve repetitive tasks like data entry, invoice matching, and approvals, leaving room for human error.

3. Staff turnover

The non-profit sector experiences a high turnover rate of around 21%. Significant turnover can increase training and hiring costs and disrupt operational continuity by creating knowledge gaps. This turnover-driven instability can further complicate already complex financial processes. Additionally, non-profit organizations risk mistakes, late payments, and strained vendor relationships if back office functions aren’t automated.

Staffing shortages have also hampered AP teams’ ability to deliver programs and services, with nearly 56% of organizations reporting that their processes have been affected by staff turnover. These staffing challenges make it especially hard for non-profits to serve the communities and people benefiting from their organization adequately.

4. Security challenges

According to NTEN, 59% of non-profit organizations lack cybersecurity training for staff. A lack of cybersecurity awareness coupled with frequent staff changes creates an environment of inconsistent security practices, hindering efforts to maintain secure and efficient financial processes.

5. Regulatory compliance

Maintaining regulatory compliance can be challenging for non-profits due to complex local, national, and, in some cases, international regulations. With limited resources and expertise in regulatory compliance, non-profits struggle to keep up since compliance is constantly evolving. Changes in laws and reporting standards require ongoing adaptation and training for finance teams. Failure to comply can result in significant financial penalties, damage to the non-profit’s reputation, and loss of trust from donors and stakeholders.

6. Transparency and accountability

Limited resources, dynamic funding sources, volunteer management, and outdated technology are all aspects that make it hard for non-profits to maintain transparency and accountability. Often operating under tight budgets and relying heavily on diverse funding streams, it can be difficult for non-profits to maintain clear financial records and adhere to reporting standards.

Understanding AP automation

AP automation uses specialized software to streamline the accounts payable process, automating tasks like invoice processing, data entry, and payment initiation to minimize manual effort.

This software captures invoice data using advanced scanning technologies, matches it to corresponding purchase orders, and processes payments accurately and on time through predefined workflows. Additionally, many AP automation solutions include features for managing comprehensive workflows, enabling customized approval hierarchies and the automated routing of invoices for approval.

How automation can improve the AP process

By implementing AP automation, your non-profit can address various operational challenges and streamline your financial management, which are listed below.

Accomplish more with fewer resources

Non-profits typically operate on tight budgets, which leads to limited staffing and financial resources. Because of that, doing more with less is crucial, especially in the face of an uncertain economic outlook.

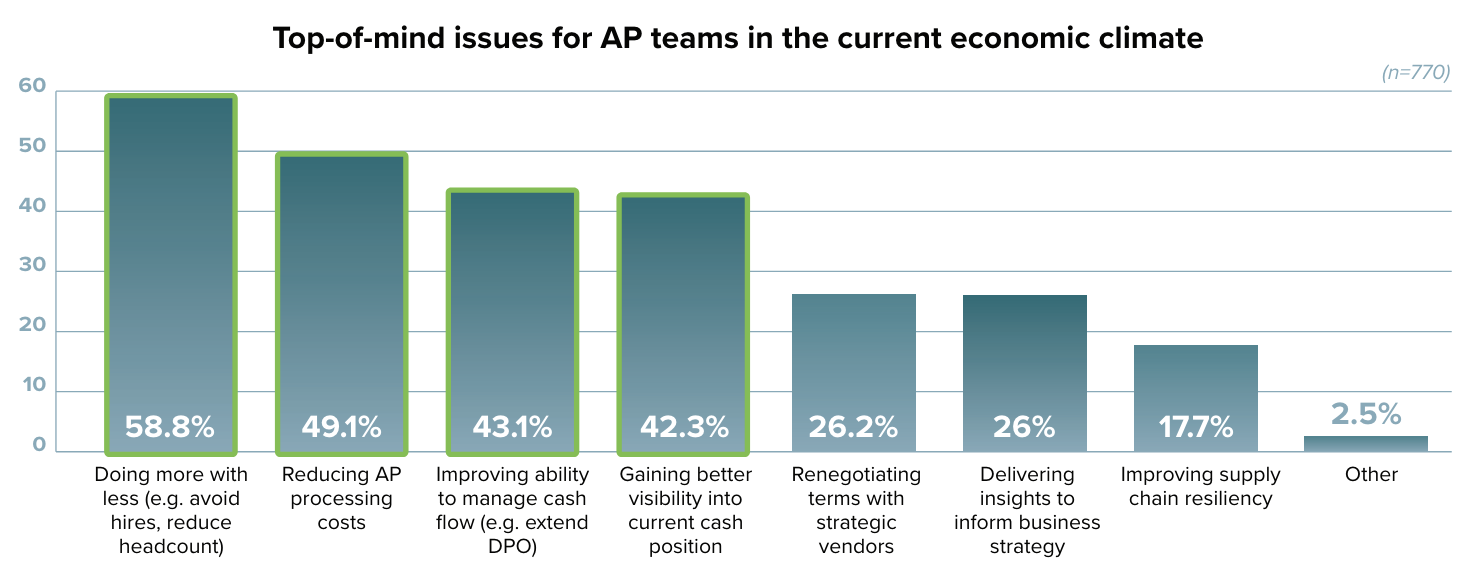

AP automation helps you process more invoices with fewer resources. According to MineralTree’s 8th annual State of AP Report, 58% of AP teams view doing more with less (e.g., avoid hires, reduce headcount) as a top-of-mind issue.

This is vital for non-profits because it allows the reallocation of funds from administrative costs to essential mission activities.

Reduce administrative burden

AP automation significantly reduces the administrative burden on your staff, freeing them from manual tasks and allowing them to focus on more strategic initiatives. As a result, you can allocate resources more efficiently and boost productivity.

Improve vendor relationships

Two-thirds of finance leaders agree that their vendor relationships have grown important this year. AP solutions enable you to automate payments, ensuring vendors are paid on time and using their preferred method. And by improving supplier relationships, you’re more likely to receive good service and favorable terms.

Boost visibility into the AP process

Automation enhances transparency in the AP process by allowing real-time tracking of each payment and transaction. This visibility enables you to monitor and manage your expenditures carefully. Additionally, teams can easily track invoices so they can ensure payments are made in a timely manner.

Improve accuracy

Automation significantly reduces human error in invoice processing and data entry. As a result, teams can also accurately forecast the impact of accounts payable and gain more insight into vendor payments.

Did you know? MineralTree’s invoice capture uses optical character recognition (OCR) paired with human review to achieve an accuracy rate of over 99%, providing high reliability in your financial reporting.

Reduce costs

AP automation can transform your back office from a cost center to a self-funded operation. You can earn cash-back rebates by reallocating spend from checks and ACH to virtual cards while providing additional protection against fraud and abuse.

Simplify the AP audit

AP automation facilitates more straightforward audits by providing clear, accessible records of all your transactions. This makes it easier to demonstrate that you are using your funds appropriately and in compliance with donor intentions.

Improve security and internal controls

Automated systems improve security throughout the AP process by standardizing and automating functions (e.g., automated checks and balances) and reducing the likelihood of human error and fraud. AP automation tools can also flag suspicious payments and invoices so AP teams can investigate.

Optimize cash flow forecasting and management

AP automation enhances cash flow management through accurate data and real-time reporting. This precision allows you to make informed financial decisions quickly. Improved tracking of incoming and outgoing funds also helps you anticipate financial needs and adjust strategies proactively.

4 tips for implementing AP automation for non-profits

AP automation solutions offer a wide range of benefits, but you need the right partner and approach to level up your AP process. Use the tips below to guide you on getting started with AP automation.

1. Find a solution that integrates with your current ERP system

Switching enterprise resource planning (ERP) solutions is costly and time-consuming. You can execute a smooth transition without operational disruption by choosing an AP automation solution that integrates with your existing system. Additionally, your ERP system remains the system of record, even if your team uses other tools to facilitate payments.

Did you know? MineralTree’s AP automation solution offers seamless integration with popular ERP systems including Sage Intacct and Oracle NetSuite.

2. Take advantage of early payment discounts

Caution in managing your expenses is crucial as a non-profit. If you take advantage of early payment discounts through your AP automation solution, you can save additional money without extra effort.

3. Convert check spend to digital spend

About 36% of companies make over half of their payments via check. However, high check usage is expensive and more susceptible to fraud. Last year, about 6 out of 10 companies have reported fraud related to checks. Additionally, check usage is more difficult to track or schedule.

However, even if non-profits have vendors who prefer checks, an AP automation solution can help improve the AP check run. Teams can use this tool to automatically print and mail checks while scheduling payments in advance.

Did you know? Of those surveyed in the State of AP Report, nearly 26% noted that vendor enrollment was the hardest part of getting started with electronic payments. MineralTree can help companies contact suppliers to enroll in digital payment methods.

4. Use analytics to optimize payments

Leveraging AP analytics tools within your system allows for more strategic payment management. The right solution enables you to streamline transaction handling and shift more payments to digital formats. With digital payments, you can take advantage of rebates to stretch your budget further.

Accounts payable improvement case studies

Let’s take a closer look at two non-profit organizations that transformed their AP processes with MineralTree’s solution.

PCA improved the invoice management process through automation

The Positive Coaching Alliance is a non-profit focused on the development of youth athletes. As they scaled their operations, the organization faced inefficiencies with manual AP tasks. In pursuit of a solution to manage their growing needs more effectively, PCA implemented MineralTree’s AP automation system.

The system helped PCA drastically cut down on manual work, reducing processing times and administrative overhead. The automation also provided a more secure and controlled environment for managing finances, allowing PCA to dedicate more effort to its mission. Read the full case study.

Community Food Bank of Eastern Oklahoma reduces manual processes in AP

The Community Food Bank of Eastern Oklahoma is a non-profit organization dedicated to feeding the hungry. Facing challenges with manual AP processes, including time-consuming paper checks and invoice handling, the organization sought to enhance operational efficiency.

By implementing MineralTree’s AP automation system, the Community Food Bank significantly streamlined its AP workflow. This transition not only improved the speed and accuracy of their payments but also shifted their payment methods from paper to electronic, increasing security and reducing fraud opportunities. Consequently, the food bank was able to reallocate more resources toward its central mission of combating hunger in Eastern Oklahoma. Read the full case study.

Final thoughts

AP automation presents a transformative opportunity for non-profits. With MineralTree, you can streamline your AP workflow and strengthen compliance and transparency— empowering you to fulfill your mission with greater confidence and less financial strain.

Request a demo today to learn how MineralTree can help your non-profit transform its AP management process.

Frequently asked questions about AP for non-profits

1. How does accounting work for non-profits?

Accounting for non-profits involves managing and reporting on funds according to donor restrictions and organizational goals. Considering these requirements, non-profits require strict adherence to financial controls and reporting standards.

2. What accounting method do most non-profits use?

Most non-profits use the accrual method of accounting, which records income and expenses when they are incurred, regardless of when cash is exchanged. This approach provides a more accurate picture of financial health than cash-based accounting.

3. Can non-profit organizations integrate their ERP with an AP automation solution?

Yes, non-profit organizations can easily integrate their ERP with an AP automation solution. Not only does this streamline the accounts payable process, but it helps improve efficiency and reduce errors associated with the manual AP process.