MineralTree® Third-Party Service Terms

These Third-Party Service Terms apply to and govern the use by Customer of various Third-Party Services used in connection with the Solution. These Third-Party Service Terms are required by the third parties that provide such Third Party Services. Capitalized terms used but not defined in the Agreement shall have the meaning ascribed in the respective attachments.

Attachment I (Priority Commercial Payments, LLC Terms and Conditions) governs direct-debit payment and related services, as updated from time-to-time in MineralTree’s sole discretion.

Attachment II (TransferMate Customer Framework Agreement) governs international payment technology and services, as updated from time-to-time in MineralTree’s sole discretion.

Attachment III (Settlement Account Addendum) governs settlement-account provision, use, access, payments and services, as updated from time-to-time in MineralTree’s sole discretion.

ATTACHMENT I TO MINERALTREE® THIRD-PARTY SERVICE TERMS

PRIORITY COMMERCIAL PAYMENTS, LLC TERMS AND CONDITIONS

You (“Customer” or “You”) have entered into an agreement with MineralTree, Inc. or its affiliate, successor or assign (“MineralTree”) pursuant to which You receive or may receive accounts payable software products or services through or as enabled by MineralTree’s software platform (the “Software Platform”). The Software Platform is separate from and interoperates with the payment processing and related services provided by or on behalf of Priority Commercial Payments, LLC (“Priority” or “us” or “we”), Sutton Bank, headquartered in Ashland, Ohio (the “Issuing Bank”), and Atlantic Capital Bank, N.A. of Chattanooga, Tennessee (the Originating Depository Financial Institution or “ODFI”), as such Issuing Bank and ODFI may change in Priority’s discretion from time to time.

These terms and conditions (the “Agreement” or “Priority Terms”) are a contract between You and Priority and govern Your access and use of all or any part of the Priority Services (defined below) provided by us and our affiliates or on our behalf pursuant to our agreement with MineralTree and the transactions You conduct through or in connection with the Software Platform and such Priority Services.

By clicking “I Agree” or otherwise using any of the Priority Services, You accept and will be legally bound to these Priority Terms. Priority is willing to provide the Priority Services only pursuant to these Terms. If You do not agree with all the Priority Terms, You may not access or use the Priority Services.

You acknowledge that Priority, the Issuing Bank, ODFI, and their respective affiliates, successors or assigns, have the right to enforce these Priority Terms directly against you and any affiliates using the Priority Services and their respective successors and assigns.

PLEASE READ THE FOLLOWING PRIORITY TERMS CAREFULLY AND KEEP A COPY FOR YOUR RECORDS.

1. Nature of Services. Subject to the terms and conditions of these Priority Terms, Priority may provide Customer various payment processing services (the “Priority Services”) as described in Section 2 for purposes of making payments to Customer’s suppliers, merchants, or other business payees (“Supplier”). The Priority Services may only be used in and for payments to Suppliers located within the United States and for services provided in the United States, and only by authorized employees and other users of Customer. Priority may modify the manner in which the Priority Services are provided and the features thereof in its discretion, and such Services may be subject from time to time to additional terms and conditions that will be provided by Priority. All services subject to availability and Priority’s approval.

2. Services to Be Provided by Priority. Subject to the applicable terms for each Priority Service, availability, and credit approval, Priority shall make available the Priority Services listed below based on Customer’s selection:

2.1. Virtual Card Solution. Priority offers a virtual card payments solution through which payments by Customers to Suppliers are made through the Visa network (the “Network”) using single-use, virtual credit cards issued by Issuing Bank (“Virtual Cards”).

2.2. CPX Direct. Priority offers Suppliers the option to accept payment by Virtual Cards through the Supplier’s card processing account with Priority.

2.3. ACH+. This is an automated clearinghouse (“ACH”) payments solution in which Suppliers pay a fee for participation. Such fees may be calculated as (i) a flat processing fee; or (ii) as part of Priority’s Dynamic Discounting offering. Under Dynamic Discounting, Suppliers agree to pay a discount in return for accelerated repayment terms. Additional terms as stated in Section 5 may apply to Customer if Dynamic Discounting is used.

2.4. Standard ACH. This is an ACH payments solution.

2.5. Supplier Enrollment. Priority and Customer will cooperate in the creation of a Supplier enrollment plan and selected payment methods. Priority will receive and parse Customer’s payment files (to be in a format and delivered in accordance with procedures in each case approved by Priority) for further payment in accordance with Sections 2.1 through 2.4 above.

3. Mineral Tree Integration and Access. Customer is a party to an agreement with MineralTree pursuant to which MineralTree provides integration software, account management, and other products and services to Customer through the Software Platform (an “Authorized User Agreement”). In connection with the MineralTree Authorized User Agreement, which includes and incorporates these Priority Terms, Customer authorizes Priority to provide MineralTree with (i) access to Customer’s Account and the Priority Services, including certain administrative functions such as initiating Virtual Card, ACH, or other payments on Customer’s account(s), and (ii) Customer’s transaction, volume, and limits data. Customer acknowledges and agrees that Priority and its affiliates and contractors shall have no liability for any actions or inaction of MineralTree with respect to the Priority Services or MineralTree’s access to such accounts. Customer authorizes Priority to rely on information and follow the instructions received by or through the Software Platform or otherwise provided by or on behalf of Customer with respect to the Priority Services, including, without limitation, existing Customer ownership data and Virtual Card and ACH Bank Accounts (defined below) information, and instructions regarding amounts to be paid to particular Suppliers using the Priority Services. Customer is responsible for all such information and instructions, whether originated at the direction of Customer or MineralTree, and all charges, fees, or other liabilities resulting with respect thereto. Customer agrees to indemnify, defend, and hold harmless Priority and Priority’s affiliates and their respective personnel, employees, officers, executives, directors, agents, successors and assigns, and contractors from and against any damages, liabilities, costs and expenses (including reasonable attorneys’ fees and litigation costs) arising out of or in connection with any reliance by Priority, Priority affiliates, the Issuing Bank, ODFI or their respective successors, assigns or contractors on Virtual Card and ACH Bank Account data, Customer ownership data, instructions, directors, and other information provided or made available to them by MineralTree or MineralTree’s contractors or their successors or assigns or through the Software Platform with respect to the Priority Services offered or made available to Customer. Customer’s representatives, including MineralTree, may access the Priority Services only as required to administer Customer’s utilization of the Software Platform and for no other purpose.

4.Additional Terms for Virtual Card Solution.

4.1. General. If Customer selects, and is approved to make payments through, Priority’s Virtual Card solution, Priority and Issuing Bank will provide Customer access to one or more accounts through which it can request payments be made to Suppliers through Virtual Cards (each a “Virtual Card Account”). All Virtual Cards used to process payments shall remain the property of Priority or the Issuing Bank, and must be returned or destroyed (with certification of destruction) upon request. Priority or the Issuing Bank may suspend, cancel, revoke, or restrict the use of any or all Virtual Card Accounts or Virtual Cards at any time, and reserve the right to decline to process any individual transactions.

4.2. Credit Limit. If Customer is approved to make payments through Priority’s Virtual Card Solution, Priority or Issuing Bank will establish a credit limit for Customer’s Virtual Card Account(s) and allow Customer to make purchases on credit through Virtual Cards up to a certain amount. Priority or Issuing Bank, in their sole respective discretions, shall be responsible for determining the amount of any such credit limit, according to their underwriting criteria and other relevant factors. Not all Customers will be eligible, and Priority and Issuing Bank reserve the right to reject a Customer, or to revoke, limit, reduce or increase a credit limit in their sole respective discretions. Any credit limit established for a Customer will be subject to periodic review and adjustment by Priority or Issuing Bank. Priority shall communicate the initial amount of any approved credit limit to Customer at the time Customer’s Virtual Card Account is approved or activated, subject to modification as noted above.

4.3. Authorization. Customer hereby authorizes Priority, directly or through its affiliates and contractors, to effect ACH Entries from the bank account(s) designated by Customer (the “Virtual Card Bank Accounts”) to cover the amounts due on any given day in connection with payments through Customer’s Virtual Card Account, including for payment of any amounts owed to Priority in connection with such services (the “Virtual Card Authorization”). For avoidance of doubt, the repayment term shall be a daily bill, daily pay model that requires Customer to pay in full the day after a payment, charge, or fee is incurred or accrues. To the extent payments are made by Priority by initiating an ACH debit, Priority reserves the right to effectuate such ACH debit to the Virtual Card Bank Accounts on the days set forth above or any other subsequent business day. Customer must ensure it has at all times sufficient funds in its Virtual Card Bank Account to cover the amounts due on any given day in connection with payments through Customer’s Virtual Card Account. In all cases, Customer will be required to ensure its unpaid balance, including all pending or unbilled transactions, fees, and other charges on the Virtual Card Account, does not exceed the established credit limit. Priority may require immediate payment of outstanding amounts, suspend further Virtual Card Account use, and/or impose additional fees, if Customer exceeds its credit limits or fails to make full or timely payment on any amounts owed. This Virtual Card Authorization is to remain in full force and effect until thirty (30) days after Priority has received written notification from Customer or MineralTree of termination of this authorization, by email to the following address: [email protected], in such time and manner as to afford Priority a reasonable opportunity to act on the notification. Customer agrees to pay the reasonable costs of collection efforts undertaken with respect to any delinquent amounts payable by Customer or with respect to Virtual Card Services provided hereunder.

4.4. Corporate Liability. Customer acknowledges and agrees that Virtual Card Accounts do not follow an individual liability model and Customer shall be liable to Priority for all payments made to Suppliers on Virtual Cards.

4.5. Non-Revolving. Credit extended through any Virtual Card Account is not revolving and the total amount due on each periodic statement is due and payable in full by the date shown on the statement. This amount includes transactions posted since the last statement date, applicable fees, amounts past due, late payment charges, charges for returned checks and other applicable charges.

5. Additional Terms for ACH+ and Standard ACH.

5.1. Acknowledgment. Customer acknowledges that ACH+ and Standard ACH are provided by Priority pursuant to these Priority Terms by virtue of Priority’s contractual relationship with the ODFI, which is a federally-insured financial institution regulated by federal and state banking agencies (“Agencies”). Priority, the ODFI, and the Agencies are relying upon the accuracy of all information provided by Customer and Customer’s performance of its obligations hereunder. Customer and Priority acknowledge that the ODFI is a third-party beneficiary of this Agreement, and ODFI has all the rights under this Agreement as if it were a party thereto. Customer agrees and acknowledges that all ACH transactions must comply with all applicable federal and state laws and the NACHA Network (“ACH Network”) Operating Rules (available at www.nacha.org).

5.2. Entries; Compliance with Rules. Priority or its affiliates and contractors will initiate credit and debit entries (an “Entry” or “Entries”) as those terms are defined by the ACH Network rules from the bank account(s) specified by Customer in the manner required by Priority by means of the ACH Network, subject to the ACH Network Rules, the Electronic Funds Transfer Act (15 U.S.C. 1693, et seq.), Regulation E (12 C.F.R. 1005, et seq.), and other applicable laws and regulations as they may change from time to time. Priority shall: (i) process Entries received from Customer that conform with the file specifications set forth in the ACH Network Rules or as otherwise required by Priority; (ii) transmit such Entries by way of an ODFI to the ACH Network; and (iii) settle such Entries as provided in the ACH Network Rules.

5.3. Authorization. Customer hereby authorizes Priority, directly or through its affiliates and contractors, to effect ACH Entries from the bank account(s) designated by Customer for ACH+ or Standard ACH (the “ACH Bank Accounts”), including for payment of any amounts owed to Priority as well as any Returns in connection with such services (the “ACH Authorization”). Customer must ensure it has at all times sufficient funds in its ACH Bank Accounts to cover the amounts due on any given day in connection with payments initiated through the ACH Service. Customer agrees that ACH payment instructions it sends to Priority shall constitute authorization for the origination of an ACH entry on Customer’s behalf to the Supplier’s (or Receiver’s) accounts. This ACH Authorization is to remain in full force and effect until thirty (30) days after Priority has received written notification from Customer or MineralTree of termination of the ACH Authorization, by email to the following address: [email protected], in such time and manner as to afford Priority a reasonable opportunity to act on the notification. Customer agrees to pay the reasonable costs of collection efforts undertaken with respect to any delinquent amounts payable by Customer or with respect to ACH Services provided hereunder.

5.4. ACH Transactions. Customer is obligated to ensure that the ACH Bank Accounts are funded at all times in the amounts necessary to fulfill all requested ACH transactions. Customer acknowledges that Priority and the ODFI have the right to periodically review the volume and character of the Entries initiated by Customer and its business operations to evaluate the credit risk associated with processing Entries on behalf of the Customer. Priority and the ODFI have the right to terminate or suspend providing services under this Agreement for breach of the ACH Network Rules and the right to audit any Customer’s, Third-Party Sender’s, or Originator’s compliance with this Agreement and the ACH Network Rules. Customer and Priority agree that all Entries transmitted to Priority for processing shall comply with the formatting and other requirements set forth in the ACH Network Rules.

5.5. Credit Entries. Customer shall pay the amount of each credit entry transmitted or processed through the ACH Services on the banking day two days prior to the date upon which the credit entry settles (the “Settlement Date”). Payment will result in individual debits for each transaction to the ACH Bank Accounts on the Settlement Date as described in the previous sentence for that day’s Settlement Date.

5.6. Debit Entries and Other Fees. Customer shall be responsible to Priority for the amount of any debit Entry submitted by Customer and returned by a receiving depository financial institution (“RDFI”) that was transmitted by Priority or its Affiliates pursuant to these Priority Terms (“Returns”), and Customer acknowledges that such transactions cannot be completed until such Return has been resolved. Priority and its Affiliates have no control over the acts or omissions of the RDFI and are not liable therefor. Customer shall promptly pay Priority the amount of any other fees owed to Priority in connection with Customer’s use of the ACH Services.

5.7. Fines, Fees, and Other Costs. In the event any payments made using the ACH Services incur any fees or interest or other charges or fees, Customer shall be solely liable for such fees or charges. Customer shall reimburse Priority for any fines, fees, interest, charges or other costs imposed on Priority or its affiliates or ODFI for any violation of the ACH Network Rules or applicable law by Customer in connection with the Standard ACH services. Priority reserves the right to offset such amounts against the Customer’s ACH Bank Account.

5.8. Late or Rejected Entries. Each Customer will be given a cut-off time for item/file submission (as they may change from time to time in Priority’s sole discretion). Any items/files received after the cut-off time will be processed the following banking day, as defined by the ODFI. Priority will notify Customer of late or rejected entries. Rejected entries will be processed upon correction and resubmission of entries by the Customer, subject to standard cut-off times. Priority may reject any Entry in its sole discretion.

5.9. Notice of Returned Entries and Notifications of Change. Priority or MineralTree shall notify Customer of the receipt of a returned entry from the ACH Network no later than one business day after the business day of such receipt. Priority shall have no obligation to retransmit a returned Entry to the ACH Network if Priority complied with these Priority Terms with respect to the original Entry. Priority shall provide Customer all information, as required by the ACH Rules, with respect to each Notification of Change (NOC) Entry or Corrected Notification of Change (Corrected NOC) Entry received by Priority relating to Entries transmitted by Customer. Priority shall provide such information to Customer within one banking day of the Settlement Date of each NOC or Corrected NOC Entry. Customer shall ensure that changes requested by the NOC or Corrected NOC are made within six (6) banking days of Customer’s receipt of the NOC information from Priority or prior to initiating another entry to the Receiver’s account, whichever is later.

6. Term and Termination. Customer and Priority may terminate this Agreement, and Priority may suspend providing any of the Priority Services to Customer, with or without cause at any time upon providing written notice to the other (which notice may be transmitted by MineralTree). In addition, termination shall automatically and immediately occur if Customer’s agreement with MineralTree to receive the Software Platform and/or Priority Services expires or terminates. Customer’s obligation to pay for all account balances, transactions, services, and other outstanding amounts and fees accrued or incurred up to the effective date of termination or expiration of these Priority Terms (including any account balances and transactions posting to accounts after such termination or expiration) shall survive termination or expiration and be payable in accordance with these Priority Terms. Upon termination or expiration of this Agreement for any reason, Customer’s right to use or access the Priority Services will immediately terminate. Customer is solely responsible for making alternate arrangements for the obtainment or continuation of services equivalent to Priority Services from and after termination or expiration, and Priority will have no liability or responsibility therefor. Without limiting or diminishing any other remedies, Priority shall have the right to withhold or delay the issuance of, or to suspend or deactivate, any Virtual Card or other Priority Services hereunder in the event Customer fails to comply fully and faithfully with the terms and provisions of this section or in the event of risk for any violation of applicable laws or regulations.

7. General Fees, Invoicing, and Payment Obligations for Payment Solutions.

7.1. Taxes. Customer shall be responsible for remitting to the appropriate tax authority any taxes that may apply to any payments that it initiates using the Priority Services, and Customer acknowledges that Priority is not .responsible for determining what, if any, taxes apply to Customer’s payments.

7.2. Non-Sufficient Funds. In the event any of Customer’s payments that are owed to Priority are dishonored, rejected, or otherwise not paid, Customer shall pay immediately to Priority the amount of the rejected payment and any non-sufficient funds charge or similar fee incurred by Priority as a result of such nonpayment, as permitted under applicable law.

7.3. Policies. Policies governing use of the Priority Services by individuals authorized by Customer to access or use the Priority Services as well as unauthorized users or anyone else accessing the Priority Services, Customer audits and other general information governing how the administration of the Priority Services (the “Policies”) are available on the Priority website (www.prioritycpx.com) and may be updated by Priority from time to time in its sole discretion. Customer will use Priority Services, including the Virtual Card Accounts, only in accordance and compliance with this Agreement and the Policies, and will ensure its users are aware of this Agreement and the Policies and comply with them.

7.4. Disputed Items. Unless required by law, Priority is not responsible for any problem Customer may have with any goods, services, or other items charged on the Virtual Card Account(s) or paid with using other Priority Services. If Customer has a dispute with a Supplier, Customer must pay Priority in accordance with these Priority Terms and attempt to resolve the dispute with the Supplier prior to sending the dispute to Priority. If Customer is unsuccessful in resolving the dispute directly with the Supplier, Priority will attempt to process the dispute to the extent it relates to a Virtual Card Account subject to the Network rules, as they may be changed from time to time, but does not guarantee resolution by the Network. Priority is not responsible if any Supplier refuses to honor any of the Priority Services.

8. Use of the Priority Services.

8.1. General. Customer agrees to comply with, and will not use the Priority Services in violation of, any applicable laws and regulations or this Agreement. Customer is solely responsible for its and its affiliates’ and contractors’ and agents’ (and their respective personnel) compliance with applicable laws and regulations and this Agreement.

8.2. Access. Customer’s users and representatives shall access and use the Priority Services only for the payment processing purposes set forth hereunder for no other purpose. Without limiting the foregoing, Customer may not: (a) circumvent, copy, modify, decompile, reverse engineer or disassemble the Priority Services or any component thereof; (b) rent, lease, sublease, license, timeshare or rebrand the Priority Services; or (c) disclose or publish performance benchmark results or test results to non-affiliated third parties with respect to the Priority Services without Priority’s express prior written consent in each instance, to be granted or withheld in Priority’s sole discretion.

8.3. Fraud Prosecution. Customer and Priority agree to cooperate with each other in preventing and prosecuting any fraudulent activity by employees of any party hereto or any third party with respect to the Priority Services, or otherwise arising in connection with any other relationship between the parties anticipated by or set forth in these Priority Terms. Priority reserves the right to interrupt, suspend, or terminate the Priority Services without notice to Customer if Priority, in its sole discretion, suspects fraudulent, illegal or abusive activity thereof or any unauthorized access to the Priority Services. Customer agrees to provide, at no cost to Priority, any and all documentation and information as Priority may request regarding any suspected fraudulent, illegal, or abusive activity or unauthorized use, including but not limited to affidavits and police reports. Failure to provide reasonable cooperation shall result in Customer’s liability for all fraudulent usage of the Priority Services.

8.4. Liability for Unauthorized Use. Except as expressly set forth in this section, Customer understands and agrees that Customer is fully liable for the unauthorized use of the Priority Services, including any Virtual Card Account, and all charges made and fees incurred with respect thereto. Customer agrees to notify Priority immediately of any actual or suspected loss, theft or unauthorized use of any of the Priority Services, including unauthorized or fraudulent use of any Virtual Card Account or any passwords or other security codes or procedures relating to such Virtual Card Account or Priority Services, by calling Priority at 855.229.5101 or sending email to [email protected]. Customer agrees to immediately inactivate any of its Virtual Card Accounts that are or are suspected of being compromised or that may be or have been used without proper authority or as a result of fraud. Customer will not be liable for unauthorized charges on a Virtual Card Account that occur after Customer notifies Priority and deactivates the Virtual Card Account as required above. Customer agrees that Priority shall have the right to suspend or cancel provision of the Priority Services, including any Virtual Card Account, after receiving notice of reported or suspected unauthorized use or fraud. Unauthorized use does not include use by a person to whom Customer has given access or authorization to use the Priority Services or who is employed or contracted by Customer or an affiliate or who is using the systems, networks or computing devices of Customer or an affiliate, and Customer will be liable for all use and charges by any such user or person.

8.5. Stopped Payment. Customer acknowledges that once a payment is processed using any Priority Services, Priority cannot “stop payment” on or cancel the transaction. If reversal of an ACH item or file is required, MineralTree can create the reversing entry(s) within the processing system, but reversals must be completed within 5 banking days of the original transaction subject to the ACH Network rules.

8.6. Suppliers. Priority does not guarantee any Supplier’s timely receipt or application of payment when Customer uses any of the Priority Services and Priority will not be liable for any late payment charges or interest assessed or any disrupted services between such Supplier and Customer that may result in the event a Supplier fails to timely receive or apply any amounts received for Customer’s account.

9. Regulation; Verification; Underwriting.

9.1. Government Regulation. To help the government fight the funding of terrorism and money laundering activities, applicable law may require Priority, Priority affiliates the Issuing Bank, the ODFI, the Network, and/or the ACH Network to obtain, verify, and record information that identifies each person who receives access to the Priority Services. Customer shall, when requested, provide to Priority, Issuing Bank, the ODFI, the Network, and/or ACH Network as relevant, documentary and other evidence of Customer’s identity, those of its beneficial owners, or the identity of any individual to whom Customer provides access to the Priority Services, so that Priority, its affiliates, the Issuing Bank, the ODFI, the Network, and/or the ACH Network may comply with any applicable law or regulation, or Network or ACH Network rules.

9.2. Verification. Customer may not be permitted to receive (and at any time Priority may suspend) the Priority Services if Priority, Priority affiliates, the Issuing Bank, the ODFI, the Network, and/or the ACH Network cannot verify Customer’s identity, financial condition, creditworthiness, or other necessary information, or suspect risk of non-compliance with laws. Customer hereby authorizes Priority, directly or through third parties, to make inquiries, checks, and screens necessary or desirable to validate information concerning the Customer’s identity, financial condition, or creditworthiness, including, but not limited to: (A) requiring Customer to confirm ownership of an e-mail address and one or more deposit accounts; (B) ordering a commercial credit report; (C) verifying Customer’s information against third-party databases or other sources; and (D) undertaking any other action necessary to verify Customer’s information. Notwithstanding any steps taken to verify such information, Customer hereby represents and warrants on behalf of Customer and any person or organization for which Customer acts that all information Customer provides to Priority is complete, accurate, and up to date. Priority shall have the right to withhold or delay the issuance of, or to suspend or deactivate, any Card or other Priority Services until Customer provides such information as may be necessary to validate the foregoing, or in the event applicable legal screens do not clear.

9.3. Disclosure. Customer agrees that Priority or its affiliates or contractors, in its sole discretion, may disclose information about Customer to satisfy Priority’s or its affiliates’ or contractors’, Issuing Bank’s, ODFI’s, Network’s, or ACH Network’s legal obligations under applicable law, including, but not limited to anti-money laundering, trade and economic sanctions laws and/or regulations, or as may otherwise be required by law, court order, or Network or ACH Network rules.

9.4. Underwriting. Customer authorizes Priority, directly or through its affiliates or contractors, to make any credit investigation Priority deems necessary and appropriate, agrees to provide Priority with such financial information as Priority may reasonably require in connection with such investigation, and authorizes Priority and its affiliates to request reports from credit bureaus. Priority or its affiliates may furnish information with respect to Customer to credit bureaus or others who may properly receive such information.

9.5. Individual Reports. If Priority determines, in its sole discretion, that it requires credit, background check, or other reports on the owners, officers, directors, or other principals of Customer in their individual capacity, Customer may not be permitted to receive the Priority Services until Priority has received appropriate authorization to obtain such reports and has conducted a satisfactory review. Customer agrees to work with Priority in timely obtaining any necessary authorizations from the appropriate individuals.

9.6. Security. Priority may, initially or from time to time, request Customer to provide security for the performance when due of Customer’s obligations hereunder. Customer understands and agrees that it is under no obligation to provide Priority with such security, but the refusal to provide security when requested may result in an adverse adjustment to Customer’s credit limit and repayment terms or suspension or termination of services. Any security provided shall be in the amount and form required by Priority in its sole discretion.

10. Data Security. Customer shall take commercially reasonable steps in accordance with generally accepted industry standards (a) to safeguard the systems it uses to transmit, process or store information from unauthorized access or use, and from viruses and other malicious code, and (b) to provide reasonable disaster recovery and business continuity capabilities for such systems.

11. Consent to Electronic Communications and Notices. Customer consents to electronic delivery of all documents related to the Priority Services, and accepts any future changes to those documents that may be delivered to Customer. By consenting to conduct transactions and receive disclosures and notices electronically Customer agrees to provide Priority with the information needed to communicate electronically. Customer agrees to keep its e-mail and account information provided to Priority current at all times.

12. Customer Data; Data Analytics.

12.1. Customer shall be solely responsible for ensuring the validity, accuracy and completeness of all information, data, files and instructions (including any personal information) provided or transmitted to Priority or its affiliates or contractors (collectively “Customer Data”). Customer hereby grants to Priority the non-exclusive, royalty-free, sublicensable right to use, process, transmit, store, display, and access Customer Data as needed to provide the Priority Services as set forth hereunder. Priority shall be entitled to rely upon the Customer Data in providing the Priority Services. Priority shall not be required to act on instructions provided by Customer or MineralTree if Priority reasonably doubts an instruction’s contents or Customer’s compliance with these Priority Terms or any legal requirements.

12.2. Priority and its affiliates and contractors may de-identify, aggregate with the data of others, or otherwise render anonymous or not identifiable to Customer or any individual user any Customer Data. In addition, Priority and its affiliates and contractors may extract information from the Customer Data and from Customer’s usage of the Priority Services and use this information and any of the de-identified, aggregated, or anonymized information covered by the prior sentence, alone or aggregated with any other data, in connection with research and development, for the improvement of the services, for statistical purposes, for administration and management of the services, for reporting to others, for legal and regulatory compliance, and for the creation and delivery of data and analytics tools and products and services (any or all of the foregoing, “Data Uses”), in accordance with applicable law. Customer represents that it has sufficient rights in the Customer Data provided hereunder (and has made sufficient disclosure to its users) to authorize such Data Uses, and that its provision, disclosure, use, storage, and transmission of Customer Data hereunder is in full compliance with all applicable laws and regulations, including those governing the obtainment of required consents. As between the parties hereto, Priority or its affiliates will own all right, title and interest in or to any and all information, data, databases, tools, products, services and intellectual property arising from such Data Uses and to any records, logs, transaction data, and other data and information resulting from the provision of the Priority Services hereunder, and Customer agrees that it will not contest or interfere in any way with Priority and its affiliates’ ownership, access to and use of such information, including use in commercial products developed as a result of or in connection with such Data Uses.

13. Confidential Information.

13.1. Confidential Information. “Confidential Information” means non-public information and materials (whether or not such information or material is marked “confidential”) that a party to these Priority Terms or its affiliate (“Disclosing Party”) discloses to or makes accessible to the other party or such other party’s affiliate (“Receiving Party”) or that a reasonable person would consider to be confidential or proprietary, including but not limited to information pertaining to the business, services, customers or technology, of Disclosing Party, such as (i) business or operating plans, strategies, know-how, portfolios, prospects or objectives; (ii) methods of operation; (iii) relationships with third parties; (iv) systems access credentials; (v) account numbers; (vi) regulatory and legal compliance information; and (vii) financial records and related information. Customer acknowledges and agrees that these Priority Terms, along with the pricing, costs and details of services, transactional information or performance of the Virtual Card Accounts, the software, systems, password-protected portals developed, utilized or maintained by Priority or its affiliates or contractors, the internal operating procedures employed by Priority or its affiliates, technical information, such as file record layouts, and transaction information, including without limitation Virtual Card numbers and data gathered at the point-of-sale by Priority, are Confidential Information of Priority and its affiliates or applicable third party licensors, and the exclusive and proprietary property of Priority, Issuing Bank, or ODFI. The BINS (Bank Identification Numbers) assigned to the Virtual Cards are the property of the Issuing Bank. Personally identifiable Customer Data that has been de-identified, or aggregated with the data of others, or otherwise rendered anonymous or is not identifiable to Customer, will not be deemed Confidential Information of Customer. Customer is solely responsible for ensuring the confidentiality of Virtual Cards, account numbers, passwords, or other security codes or procedures applicable to Customer’s and its users’ access and use of the Priority Services.

13.2. Obligations. Each Receiving Party agrees to treat with confidentiality, to make reasonable efforts to safeguard against unauthorized use, and not to use for any purpose not related to these Priority Terms or as required for audits, legal or regulatory compliance the Confidential Information of the Disclosing Party, and to disclose such information only to its or its affiliates’ employees, contractors, funding sources, issuing banks, ODFI, advisors, governmental authorities for purposes relating to these Priority Terms, or for corporate, audit, legal or regulatory compliance or to successors or assigns in connection with a sale, transfer, assignment or delegation of these Priority Terms or any of the services hereunder. This Section 13 does not restrict Data Uses.

13.3. Equitable Relief. Priority and Customer agree there is no adequate remedy at law for a breach of the requirements of this Section 13 (collectively, the “Confidentiality Requirements”). A breach of the Confidentiality Requirements will cause irreparable harm such that the non-breaching party will not have an adequate remedy at law; and, therefore, the non-breaching party will be entitled to seek injunctive relief (without posting a bond or other security) against the breaching party In addition to any other rights or remedies available at law or in equity.

14. Representations and Warranties. Customer represents and warrants that (a) it is duly organized, validly existing, and in good standing in its jurisdiction of organization; (b) it is a governmental, nonprofit, or commercial business enterprise; (b) the execution of and compliance with these Priority Terms and use of the Priority Services (i) is within its power, has been duly authorized by all necessary corporate action, and will not result in a breach of any organizational document of Customer; (ii) does not violate any requirements of applicable law or regulation; (iii) does not require Customer to obtain or give any registration with, approval of, notice to, or any action by any other person; and (iv) will not result in a breach of any agreement binding upon Customer; (c) these Priority Terms have been duly executed and delivered by Customer and constitutes a legal, valid, and binding obligation of Customer, enforceable in accordance with its terms; (d) Customer, its employees, and its other authorized users will use the Priority Services only for valid and lawful business purposes to Suppliers; (e) Customer will not make or request a payment to the types of companies listed on Schedule 1 hereto (as it may be amended by Priority from time to time), and (f) Customer will not resell or sublicense the Priority Services to any third parties or use them on a third party’s behalf.

15. Disclaimer; Limitation of Liability; Force Majeure.

15.1. Disclaimer of Warranties. PRIORITY DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED OR STATUTORY WITH RESPECT TO THE PRIORITY SERVICES OR MATTERS RELATING TO THESE PRIORITY TERMS, INCLUDING WITHOUT LIMITATION, WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE, NONINFRINGEMENT, SECURITY, QUIET ENJOYMENT, ADEQUACY OR SUFFICIENCY, UNINTERRUPTED SERVICE, AND ANY IMPLIED WARRANTIES ARISING OUT OF ANY COURSE OF DEALING OR USAGE OF TRADE. THE PARTIES AGREE THAT ANY STATE LAWS ADOPTING THE UNIFORM COMPUTER INFORMATION TRANSACTIONS ACT (UCITA) DO NOT APPLY TO THESE PRIORITY TERMS AND ANY WARRANTIES CONTAINED THEREIN ARE EXPRESSLY DISCLAIMED HEREIN.

15.2. Limitation of Liability – Priority. Customer acknowledges that Priority’s performance of the Priority Services is dependent on performance by numerous other parties, including, but not limited to, the Issuing Bank, ODFI, Network, and ACH Network, among others. Priority does not guarantee timely delivery of all payments and shall not be liable for any loss or damage of any type suffered by Customer as a result of any delay in the receipt of payments by a Supplier or other payee. Priority and its affiliates and contractors shall not be responsible for Customer’s or its users’ acts or omissions (including, without limitation, the amount, accuracy, timeliness of transmittal, or authorization received from Customer) or those of any other person or entity. Priority does not guarantee any Payee’s timely application of payment when Customer uses the Priority Services and Priority will not be liable for any late payment fees assessed or any disrupted services between such Payee and Customer.

15.3. Limitation of Liability – Mutual. EXCEPT AS EXPRESSLY PROVIDED HEREIN AND WHERE THIS EXCLUSION OR LIMITATION WOULD BE VOID OR INEFFECTIVE UNDER APPLICABLE LAW, IN NO EVENT SHALL PRIORITY BE LIABLE FOR INDIRECT, SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES (INCLUDING LOST PROFITS OR SAVINGS OR COST FOR REPLACEMENT SERVICES), WHETHER BASED ON CONTRACT, TORT (INCLUDING NEGLIGENCE), OR ANY OTHER LEGAL THEORY, EVEN IF ADVISED OF THE POSSIBILITY OF SUCH DAMAGES. IN NO EVENT SHALL VENDORS, BANKS, CARD ISSUERS, THE NETWORK, THE ACH NETWORK, AND OTHER THIRD PARTIES PROVIDING GOODS OR SERVICES TO PRIORITY OR A PRIORITY AFFILIATE HAVE ANY LIABILITY FOR DAMAGES ARISING FROM THE PRIORITY SERVICES OR AS A RESULT OF THESE PRIORITY TERMS OR THE MINERALTREE AGREEMENTS. IN NO EVENT SHALL PRIORITY’s LIABILITY TO CUSTOMER UNDER THESE PRIORITY TERMS EXCEED AN AGGREGATE AMOUNT OF TEN THOUSAND DOLLARS ($10,000.00), REGARDLESS OF THE NUMBER OF CLAIMS OR THE FORM OF ACTION OR DAMAGES. THIS SECTION 15 SHALL SURVIVE THE EXPIRATION OR TERMINATION OF THESE PRIORITY TERMS FOR ANY REASON. WITHOUT LIMITING THE FOREGOING, THE PARTIES AGREE THAT PRIORITY AND ITS AFFILIATES ARE NOT RESPONSIBLE FOR ANY ACTS OR OMISSIONS OF CUSTOMER OR SUPPLIERS.

15.4. Force Majeure. Priority shall not be liable for any failure or delay in performing hereunder if such failure or delay is caused by conditions beyond its reasonable control, including but not limited to, acts or omissions of MineralTree; acts of God, embargoes, governmental restrictions, strikes, riots, insurrection, wars, or other military action, acts of terrorism, civil disorders, rebellion, fires, floods, vandalism, or sabotage; acts of government, the Network or ACH Network, or regulatory agencies; or failures or fluctuations in electrical power, heat, light, air conditioning, computer or telecommunications services or equipment.

16. Indemnification.

16.1. Indemnity. Customer will defend at its expense and indemnify Priority against any third party claims and damages and costs incurred by or awarded against the Priority with respect thereto and settlement amounts to resolve such claims that are approved by both parties, to the extent arising out of: (a) the gross negligence of Customer with respect to matters relating to these Priority Terms; (b) the willful misconduct of Customer with respect to matters relating to these Priority Terms; (c) any breach of the representations, warranties or covenants made by Customer in these Priority Terms, or any dispute regarding the proposed or actual use of any Priority Services to make a payment on behalf of Customer, whether that dispute involves the person to receive the payment or a third party.

16.2. Process. Priority will notify Customer in writing of any demands or claims for which indemnification will be sought. Customer shall assume the defense of any such demand or claim and pay all expenses incurred by it or at its request in connection therewith, including attorney’s fees, and promptly pay, discharge, and satisfy any judgment or decree that may be entered against it or Priority in respect of such demand or claim. Customer shall have the right to approve in writing any settlements of any matters for which indemnification would be due to Priority. Priority shall follow any reasonable written instructions received from Priority in connection with such claim.

17. Intellectual Property. Customer agrees that all web-pages, service marks, logos, trademarks, content, software, services (including without limitation the names Priority or Virtual Credit Card Solution), applications, processes and systems used by Priority or its affiliates to provide the Virtual Credit Card Solution and any intellectual property rights therein are the sole property of Priority or such affiliate or their respective licensors, and may only be used by Customer to the extent expressly permitted by these Priority Terms and only while these Priority Terms are in effect. All rights not expressly granted to Customer are reserved by Priority, its affiliates and third party licensors. Subject to and only as long as these Priority Terms are in effect, Priority grants to Customer a non-exclusive right without the right to grant sublicenses to access and use the Virtual Credit Card Solution as contemplated by these Priority Terms and only as permitted by the Customer’s agreement with MineralTree solely for Customer’s internal business purposes. As between Priority and Customer all payment transaction data shall be property of Priority or its affiliates, unless otherwise required by law or Network or ACH Network rules.

18. Waiver of Jury Trial. THE PARTIES HERETO WAIVE ALL RIGHT TO TRIAL BY JURY IN ANY ACTION, SUIT, OR PROCEEDING BROUGHT TO RESOLVE ANY DISPUTE, WHETHER IN CONTRACT, TORT, OR OTHERWISE ARISING OUT OF, CONNECTED WITH, RELATED TO, OR INCIDENTAL TO THESE PRIORITY TERMS OR A PARTY’S PERFORMANCE HEREUNDER.

19. Independent Contractors. The parties intend that an independent contractor relationship will be created by these Priority Terms and that no agency, fiduciary relationship, employment relationship, joint venture, or partnership will be established thereby. The employees or agents of one party shall not be deemed or construed to be the employees or agents of the other party for any purpose whatsoever. Neither party will have any authority, and neither party will represent that it has any authority, to assume or create any obligation, express or implied, on behalf of the other party, except as specifically set forth in these Priority Terms. In addition, Priority is an independent contractor to MineralTree and nothing contained in these Priority Terms or the provision of the Priority Services shall be interpreted, construed, or implied to create any agency, partnership, or joint venture between Priority or its affiliates and MineralTree.

20. Subcontracting. Priority may use subcontractors or other third parties to fulfill its obligations under these Priority Terms and any of the transactions contemplated thereby, to be selected and retained in its sole discretion.

21. Assignment. Customer may not assign or transfer (including by operation of law) these Priority Terms or its access to or use of the Priority Services without the prior written consent of Priority. Priority may assign or transfer (including by operation of law) the Priority Terms or any of the Priority Services without Customer’s consent. These Priority Terms will be binding on the parties and their respective permitted successors and assigns. Any assignment in violation of this Section will be void.

22. Publicity. Each party agrees not to use the other party’s name or refer to the other party, directly or indirectly, in any media release, public announcement, or public disclosure relating to these Priority Terms, including without limitation in any promotional or marketing materials, customer lists, referral lists, or business presentations, without the prior written consent of the other party, which may be given for each such use or release or generally. Notwithstanding the foregoing, a party has the right to use the name of the other in order to make disclosures and filings required by securities and other applicable laws, to describe to funding sources, potential acquirers or investors, advisors and auditors the relationship of the parties hereunder and the existence of these Priority Terms, and as otherwise required to perform the Priority Services required under these Priority Terms. Except as specifically provided in these Priority Terms, a party may not use the name, logo, trademark, or service mark of the other party without the other party’s prior written consent.

23. Notices. Except as otherwise provided herein, all notices under these Priority Terms will be in writing and shall be personally delivered by hand, sent by Federal Express or equivalent recognized courier (signature required), sent by registered or certified mail (return receipt requested), or transmitted by facsimile or email with same day telephone communication confirming receipt and subsequently confirmed by registered or certified mail. Notices shall be sent to the receiving party’s address listed below, or to such other address of which the receiving party has notified the sending party in the manner provided in this section. Notice will be deemed given: (a) when personally delivered to an officer of the party to whom the notice is addressed; (b) on the date of actual receipt when sent by Federal Express or equivalent recognized courier, or by registered or certified mail; (c) on actual receipt when sent by facsimile or email to the number set forth below with confirmation of receipt through the other form of communication and subsequently confirmed by registered or certified mail:

Customer Priority

Physical Address 2001 Westside Parkway, Suite 155

City, State Zip Alpharetta, GA 30004

Attn: Attn: General Counsel

Facsimile: Facsimile: 866-321-8777

Email: [email protected]

24. Miscellaneous.

24.1. Entire Agreement. Any prior or contemporaneous agreements, proposals, presentations, contracts, promises, or representations between the parties or their affiliates or representatives concerning the subject matter of these Priority Terms are merged into and superseded by these Priority Terms, which along with any addenda, attachments, schedules, and exhibits included herein or that specifically reference these Priority Terms, and changes permitted hereunder, constitutes the entire understanding between the parties concerning the subject matter of these Priority Terms.

24.2. Order of Precedence. In the event of a conflict between these Priority Terms and any attachment, schedule, or exhibit to these Priority Terms, the terms and conditions of the attachment, schedule, or exhibit will control to the extent of the conflict for the subject matter of such attachment, schedule, or exhibit.

24.3. Modification of Agreement. Except as otherwise set forth herein, no modification of these Priority Terms will be valid unless in writing and signed by authorized representatives of each party.

24.4. No Waiver. No waiver of any of the provisions of these Priority Terms will be valid unless in writing and signed by the party making the waiver. A waiver of one provision does not operate as a future waiver of that or any other provision of these Priority Terms.

24.5. Governing Law. These Priority Terms are governed by the laws of the United States of America and the laws of the State of Georgia, without regard to principles of conflicts of law. Any action brought in connection with these Priority Terms shall be brought exclusively in the federal and state courts in the State of Georgia, and each party hereby consents to personal jurisdiction over it by such courts.

24.6. Severability. If any provision of these Priority Terms is held invalid or unenforceable, that provision will be construed, limited, modified, or, if necessary, severed, to the extent necessary, to eliminate its invalidity or unenforceability, and the other provisions of these Priority Terms will remain unaffected. The parties will make a reasonable effort to modify the invalid or unenforceable provision to render it enforceable in accordance as closely as possible to the intent of the original provision.

24.7. California Consumer Privacy Act. In the event and to the extent that any “Personal Information” of any “consumer” (each as defined in the CCPA) is collected, used, stored, or otherwise processed by Priority (“Service Provider”) in connection with the provision of Priority Services hereunder, Service Provider shall abide by all requirements applicable to Service Providers under the California Consumer Privacy Act (“CCPA”), Cal. Civ. Code 1798.100 et seq., with respect to such Personal Information. Service Provider will use such Personal Information only (a) in connection with the provision of Priority Services hereunder, or (b) as required or expressly permitted under applicable law, including the CCPA. To the extent applicable, Service Provider will (i) notify Customer of any consumer rights requests Service Provider receives from individuals whose Personal Information is processed by Service Provider; and (ii) upon request, provide Customer with reasonable assistance in fulfilling any consumer rights requests Customer receives from individuals whose Personal Information is processed by Service Provider.

SCHEDULE 1 TO PRIORITY COMMERCIAL PAYMENTS, LLC TERMS AND CONDITIONS

PROHIBITED BUSINESS

- Shell banks

- Any entity or individual that is listed on the U.S. Department of the Treasury OFAC List of Specially Designated Nationals or Blocked Persons, or who is otherwise the target of an economic sanctions program administered by OFAC.

- Used vehicle dealers who export any car, truck, sport utility vehicle (SUV), or similar vehicle

- Foreign Entities who import any used car, truck, SUV, or similar vehicle from the United States

- Businesses involved in payday lending

- Businesses involved in title lending

- Money service businesses whose primary business (50% or more gross revenue)is: check casher; money transmitter; currency exchanger; currency dealer; issuer, seller, or redeemer of traveler’s checks; issuer, seller, or redeemer of money orders; issuer, seller, or redeemer of stored value cards and/or pre-paid gift cards (excluding domestic money transmitters or providers of pre-paid access for business to business purposes opened by Corporate/Commercial Relationship Managers (RMs) in coordination with Treasury Management Officers)

- Money Service Businesses who are currency exchangers of cryptocurrency, currency dealers of cryptocurrency, or transmitters of cryptocurrency are prohibited, regardless of percentage of gross revenue

- Foreign Money Service Businesses

- Foreign Private Investment Companies (PICs) (excluding those opened by Private Wealth Banking, Regions Trust, or otherwise pre-approved by the EDD Review Team)

- Foreign and Domestic Correspondent Banks

- Foreign Casino and Bingo Operations

- Foreign Third-Party Payment Processors

- Foreign Securities and Commodities Firms

- International Business Corporations (IBCs) (excluding those opened by Private Wealth Banking, Regions Trust, or otherwise pre-approved by the EDD Review Team)

- Accounts structured to obscure ownership identity, such as numbered/pseudonym, payable through accounts and certain concentration accounts

- Deposit Brokers (excluding Institutional Certificates of Deposit and Retail Certificates of Deposit opened by Finance based on established criteria)

- Embassy and Foreign Consulate Accounts

- Custody Accounts for Third Party Managers (excluding those opened by Regions Trust)

- Custody Accounts for Third Party Managers Involving Promissory Notes for Ongoing Investment Programs

- Providers of Internet Gambling Services

- Third-Party Payment Processors whose customers are mail order and telephone order companies, telemarketers, offshore companies, on-line gambling related operations, internet based establishments, prepaid travel, on-line payday lenders, and adult entertainment businesses

- Businesses which manufacture, distribute, or dispense marijuana (marijuana-related businesses)

- Adult entertainment businesses in the form of strip clubs and escort services

- On-line or other advertisers or facilitators which promote (create, sell, market, or distribute advertisements) escort services, excluding safety escorts

ATTACHMENT II TO MINERALTREE® THIRD-PARTY SERVICE TERMS

TRANSFERMATE CUSTOMER FRAMEWORK AGREEMENT

This Framework Agreement (this “Framework Agreement”), which contains the terms and conditions that govern your access to and use of the Services (as defined below), is an agreement between TRANSFERMATE INC., a company incorporated and registered in incorporated in Illinois whose registered office is 333 N. Michigan Ave, Suite 915, Chicago, IL 60601 trading as TransferMate, TransferMate Global Payments, TransferMate Education and other names (“Transfermate”) and you or the entity you represent (“Customer”). By Accepting this Framework Agreement by executing an order form with MineralTree (as defined below) that references this Framework Agreement, Customer agrees to the terms of this Framework Agreement. If you are entering into this Framework Agreement for an entity, such as the company you work for, you represent that you have legal authority to bind that entity. For the purposes of Section 20.3 (Notice Address), Customer’s notice address shall be the address set forth in the order form with MineralTree.

WHEREAS

(A) Transfermate is a service provider which provides technology solutions incorporating international money remittance and foreign exchange services, and whose Subsidiaries are authorised and regulated to provide payment services in various jurisdictions globally.

(B) Transfermate is a strategic partner of MineralTree, Inc. (“MineralTree”) under which certain of Transfermate’s payments solutions are accessible through the Platform.

(C) The Customer wishes to procure technology and payment services hereunder from Transfermate for use through the Platform or through the Website.

(D) Transfermate is willing to provide such services to the Customer through the Platform or the Website in accordance with the terms and conditions of this Framework Agreement. This Framework Agreement is in addition to any separate terms and conditions, privacy policies, and other rules required by MineralTree, either related to the Services or otherwise.

IT IS AGREED AS FOLLOWS

1. INTERPRETATION AND DEFINITIONS

1.1. In this Framework Agreement:

1.1.1. references to persons includes, individuals, bodies corporate (wherever incorporated), joint ventures, unincorporated associations and partnerships or any State body;

1.1.2. the headings are inserted for convenience only and do not affect the construction of the agreement;

1.1.3. the use of the singular number shall be construed to include the plural, and the use of the plural the singular, and the use of any gender shall include all genders.

1.1.4. any reference to any Applicable Law or other enactment or statutory provision is a reference to it as it may have been, or may from time to time be amended, modified, consolidated or re-enacted;

1.1.5. any phrase introduced by the words “including”, “includes”, “in particular”, “for example” or similar shall be construed as illustrative and without limitation to the generality of the related general words;

1.1.6. any reference to a document shall include all authorised amendments of, supplements to and replacements of that document;

1.1.7. any obligation not to do anything shall include an obligation not to suffer, permit or cause that thing to be done;

1.1.8. References to clauses are to clauses of this Framework Agreement; and

1.1.9. a reference to anybody shall, if that body is replaced by another organization, be deemed to refer to that replacement organization and if that body ceases to exist, be deemed to refer to the organization which most or substantially serves the same purpose or functions as that body.

1.2. The additional terms contained in the schedules (and all documents incorporated or referenced therein) (the “Schedules”) form part of this Framework Agreement.

1.3. In the event of any conflict or inconsistency between the terms of this Framework Agreement and any document or agreement referred to herein such conflict shall be resolved in the following order of priority:

1.3.1. Schedule 1;

1.3.2. the terms of this Framework Agreement; and

1.3.3. the remaining Schedules to this Framework Agreement.

1.4. For the purpose of this Framework Agreement, capitalized terms shall have the following meaning:

1.4.1. Account means the Transfermate account that is created in connection with the Customer being granted access to the Platform or Website;

1.4.2. Applicable Laws means all statutory instruments, regulations, orders and other legislative provisions which in any way relate to this Framework Agreement or the provision of the Services;

1.4.3. Beneficiary means the intended recipient of the Payment Transaction who will be notified to Transfermate by Customer through the Platform or Website;

1.4.4. Business Day means a day (other than a Saturday or Sunday) on which banks are generally open for business in New York;

1.4.5. Charges means the charges agreed between Customer and MineralTree;

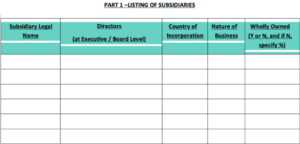

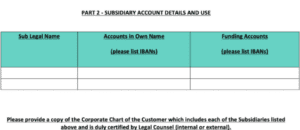

1.4.6. Corporate Chart means a diagram which sets out the entities in the Customer’s group structure, including details of all of the Subsidiaries of the Customer.

1.4.7. Account Information means all information required by Transfermate to complete an application to open an Account, including, but not limited to know your customer information, anti-money laundering information, and associated Customer and User information. Account Information includes Personal Data.

1.4.8. Data Protection Laws means all applicable privacy and data protection law;

1.4.9. Effective Date means the date of execution of this Framework Agreement and where executed on two different dates shall mean the later of the two execution dates;

1.4.10. Final Transfer means the transfer of funds by Transfermate into the account of the Beneficiary;

1.4.11. Framework Period means the term of this Framework Agreement commencing on the Effective Date until terminated.

1.4.12. Funding Account means those accounts listed in Schedule 2.2 which Customer wishes to use to fund Payment Transactions, whether entered by Customer or by Customer’s Subsidiary;

1.4.13. Intellectual Property Rights means patents, trademarks, service marks, logos, get-up, trade names, internet domain names, rights in designs, copyright (including rights in computer software) and moral rights, database rights, semiconductor topography rights, utility models, trade secrets, rights in know-how and other intellectual property rights, in each case whether registered or unregistered and including applications for registration and rights to apply, and all rights or forms of protection having equivalent or similar effect anywhere in the world;

1.4.14. Lodgement means the transfer of funds from the Funding Account to the Nominated Account in respect of the Payment Transaction;

1.4.15. Nominated Account means the Transfermate bank account to which Your Lodgement is required to be made;

1.4.16. Payment Transaction refers to the agreement for Transfermate to effect a funds transfer on Customer’s behalf whether at a live exchange rate, a pre-agreed exchange rate or without a foreign exchange element;

1.4.17. Platform means the platform, portal and/or marketplace hosted by MineralTree and provided directly to the Customer under a separate legal agreement between Customer and MineralTree;

1.4.18. Services means the services set out at Schedule 1 but for clarity include only those Services provided by Transfermate and do not include the access or use of the Platform;

1.4.19. Subsidiaries has the meaning given to that term by Section 7 of the Companies Act 2014;

1.4.20. Terms and Conditions means the terms and conditions of this Framework Agreement;

1.4.21. Transfermate Personnel means the employees and permitted agents of Transfermate;

1.4.22. Website means transfermate.com, or where the context so permits, other portals and APIs that are hosted by Transfermate.

2. CLAUSE RESERVED

3. SERVICE OBLIGATIONS

3.1. Transfermate shall provide the Services to the Customer in accordance with the terms of this Framework Agreement and Applicable Laws.

3.2. The provision of the Services shall be subject to the service terms set out at Schedule 1 (“Service Terms”), which may be updated from time to time by Transfermate and notified to the Customer in accordance with clause 10.

3.3. The Services provided by Transfermate are provided on an execution only basis, meaning that Transfermate does not provide any investment advice, including without limitation, on the merits of the Services and its likely implications. Customer must make a decision to use the Services based solely on Customer’s own judgment, having availed of, if necessary, prior independent financial advice. It is for each Customer to evaluate whether the Services are appropriate in terms of each Customer’s experience, financial objectives, and circumstances.

4. CUSTOMER OBLIGATIONS

4.1. The Customer shall comply with its obligations as set out in Schedule 1 and within this Framework Agreement.

4.2. Customer shall be obliged to complete Schedule 2.2 in respect of each Funding Account to the satisfaction of Transfermate, prior to which no Services may be provided by Transfermate. Where additional Funding Accounts are requested to be added following the commencement of Services, Transfermate shall make all reasonable efforts to process such requests on receipt of a written request from the Customer which provides equivalent detail to that set out in Schedule 2.2. In the event that a Subsidiary holds the Funding Account then either (1) that Subsidiary must be listed in Schedule 2.1, or (2) the Subsidiary must first be added as a beneficiary of the Services as set out in clause 19.3.

4.3. It is the Customer’s obligation alone to ensure compliance with any Applicable Laws relevant to Customer’s country of residency with regards to the use of the Services. For avoidance of doubt, the ability to access to the Services does not necessarily mean that the Services, and/or Customer’s activities through it, are legal under the Applicable Laws relevant to Customer’s state or country of residence.

4.4. The Customer confirms that they have read and shall comply with Transfermate’s AML Policy set out at Schedule 3.

4.5. The Customer confirms that it consents to MineralTree sharing Account Information with Transfermate for the purpose of performing Transfermate’s obligations under this Agreement. Customer acknowledges and agrees that MineralTree shall have no responsibility or liability arising from or related to the accuracy, quality or legality of such Account Information.

5. TRANSFERMATE PERSONNEL

5.1. Transfermate shall be responsible for the acts and omissions of all Transfermate Personnel.

5.2. Transfermate shall ensure that Transfermate Personnel provided are suitably qualified, adequately trained and capable of providing the applicable Services for which they are engaged.

6. COMMUNICATIONS, USERS ACCESS AND SECURITY

6.1. Communications:

6.1.1. Other than the formal notices provided for at clause 20.2, all communications in relation to the operation of the Services shall be by the MineralTree engagement channels available to the Customer on the Platform or by the Website.

6.2. User Set Up and Monitoring:

6.2.1. MineralTree shall notify Transfermate of the persons that Customer requires to have access to the Services (the “Users”).

6.2.2. All Users must be approved and registered by Transfermate before using the Services, and access to the Services shall be strictly restricted to approved Users. Transfermate is under no obligation to approve a User.

6.2.3. Customer is obliged to immediately notify Transfermate through the Platform or Website of any change to the list of Users.

6.2.4. It is the Customer’s obligation to ensure that each User understands the Services and has the legal authority to access the Services. Neither Transfermate nor MineralTree is under any obligation to conduct checks on Users or oversee a User’s activity.

6.3. Access and Passwords:

6.3.1. Upon logging onto the Platform or Website and selecting to use the Service (i.e., by entering the username and the corresponding password), access will be granted to each User, and neither Transfermate nor MineralTree will be required to take any further steps to verify that the person accessing the Account is a User.

6.3.2. Each User’s registration is for that User only. Users are prohibited from sharing their username and password with any other person, and to do so shall be a material breach of these Terms and Conditions by the Customer.

6.4. Safeguards and Corrective Measures

6.4.1. Each Party shall implement appropriate technical and organizational measures to assure a level of security appropriate to the risk associated with the delivery and receipt of the Services.

6.4.2. Each Party shall promptly inform the other Party of any actual or suspected unauthorized access, use or other abuse of either their respective systems which impacts on the Service, of which it becomes aware.

7. WARRANTIES

7.1. Each party warrants that:

7.1.1. This Framework Agreement is executed by a duly authorized representative of that Party; and

7.1.2. It has the corporate power and capacity to enter into this Framework Agreement and to perform its obligations.

7.2. Transfermate warrants to the Customer that:

7.2.1. the Services shall be provided exercising all due skill, care and diligence;

7.2.2. the Nominated Accounts shall be set up for the sole purpose of receiving Lodgements, and remitting Final Transfers to Beneficiaries. The Nominated Accounts and all funds in the Nominated Accounts will be segregated from any funds belonging to Transfermate, its affiliates or any third party. Transfermate agrees that, to the extent permitted by law, it will ensure that no lien may be placed on the funds in the Nominated Accounts; and

7.2.3. it has full legal right, power and authority to provide the Services to Customer.

7.3 Except as provided in this Framework Agreement, there are no express warranties, representations, undertakings terms or conditions (whether or written, express or implied by statute, common law or otherwise) made by Transfermate and all warranties, representations, undertakings, terms and conditions (whether or written, express or implied by statute, common law or otherwise) implied to be made by Transfermate including without limitation implied warranties as to satisfactory quality, fitness for a particular purpose and the use of reasonable care and skill which, but for this legal notice, might have effect in relation to the Services, are hereby excluded to the extent permitted by law.

8. DATA PROTECTION

8.1. In this Framework Agreement, the terms Personal Data, Data Processor, Supervisory Authority, Data Subject, process, and Data Controller are as defined in the Data Protection Laws, and cognate terms shall be construed accordingly. Subprocessor means any person (including any third party, but excluding an employee of Transfermate or any of its sub-contractors) appointed by or on behalf of Transfermate to process Personal Data in connection with this Framework Agreement.

8.2. Both Parties acknowledge that in performing its obligations under this Framework Agreement and in the Customer availing of the Services, Transfermate may process Personal Data on behalf of Customer. In such circumstances, the Parties acknowledge that Customer is the Data Controller and Transfermate is the Data Processor in respect of the Personal Data it Processes on behalf of the Customer, and Transfermate shall comply with its then in force Privacy Policy.

8.3. Transfermate agrees that it shall acquire no rights or interest in the Personal Data, and shall only Process the Personal Data in accordance with this Framework Agreement and any other written instructions of the Customer unless required to do so by applicable Data Protection Law to which the Data Processor (or its Subsidiaries) is subject, and in such a case, the Data Processor shall notify the Customer of that legal requirement before processing, unless that law prohibits such notification.

8.4. Customer understands that the delivery of the Services shall necessitate Transfermate on occasion to transfer Customer Personal Data internationally, and the

8.5. Transfermate agrees to assist the Customer, including taking appropriate technical and organizational measures, to respond to requests by data subjects, exercising their rights under Data Protection Law, within such reasonable timescale as may be specified by the Customer.

8.6. Transfermate will ensure that its Personnel who Process Personal Data under this Framework Agreement are subject to obligations of confidentiality in relation to such Personal Data.

8.7. Transfermate shall implement appropriate technical and organizational measures to assure a level of security appropriate to the risk to the security of Personal Data, in particular, from accidental or unlawful destruction, loss, alteration, unauthorized, disclosure of or access to Personal Data including:

8.7.1. the pseudonymization and encryption of Personal Data;

8.7.2. the ability to ensure the ongoing confidentiality, integrity and availability and resilience of Transfermate’s systems used for such Processing;

8.7.3. the ability to restore the availability and access to Personal Data in the event of an incident; and

8.7.4. a process for regularly testing, assessing and evaluating the effectiveness of technical and organizational measures for ensuring the security of the processing.

8.8. Transfermate agrees that neither it nor its Subsidiaries shall engage any third party to Process the Customer’s Personal Data without imposing on such third party, by means of a written contract, the same data protection obligations as set out in this Framework Agreement and shall ensure that if any third party engaged by Transfermate in turn engages another person to Process any Personal Data, the third party is required to comply with all of this Clause’s obligations in respect of Processing of Personal Data.

8.9. Transfermate shall remain fully liable to the Customer for Processing by any third party as if the Processing was being conducted by Transfermate.

8.10. Transfermate will immediately inform the Customer if, in its opinion, an instruction given, or request made pursuant to this agreement infringes Data Protection Law.

9. CHARGES AND TAXATION

9.1. There are no charges payable directly to Transfermate for the provision of the Services hereunder.

9.2. Customer shall pay MineralTree directly for all Charges arising from the Services hereunder and any invoice disputes, questions or other invoice related matters are between Customer and MineralTree.

10. CHANGE CONTROL

10.1. Transfermate reserves its right to make incremental changes to the Services provided and where those amendments are classified by Transfermate, acting in good faith as upgrades, updates or improvements to the Services, which have no adverse impact on the Customer, or are a result of Transfermate’s compliance with Applicable Laws, the changes shall not be required to compel with the provisions of case 20.7. Such changes foreseen herein, shall be limited to changes to Schedule 1 and Schedule 3, and shall be notified to the Customer using the means provided for under clause 6.1 in advance of taking effect, and if the Customer disputes Transfermate’s right to make such a change, then the matter shall be treated as a Dispute under clause 20.15.

10.2. Other than those incremental changes set out at clause 10.1, other Framework Agreement changes are governed by clause 20.7.

11. INDEMNITY AND LIMITATIONS OF LIABILITY

11.1. Neither Party limits or excludes its liability for:

11.1.1. Death or personal injury caused by its negligence or the negligence of its employees;

11.1.2. Fraud or fraudulent misrepresentation by it or its employees;

11.1.3. Any act or omission of the Party which causes the other Party to be in breach of Data Protection Laws; or

11.1.4. Any liability to the extent that it cannot be limited or excluded by Applicable Laws.

11.2. Customer assumes responsibility in full for any direct losses arising from:

11.2.1. all Payment Transactions entered by Users using authorised usernames and passwords; and